The payroll cycle

Step 6: Calculate pay

Calculating pay is the process of taking what we have done so far and making temporary changes to calculate the final pay for this pay period.

-

Go to the Payroll menu.

-

Select Do/Redo Payroll.

-

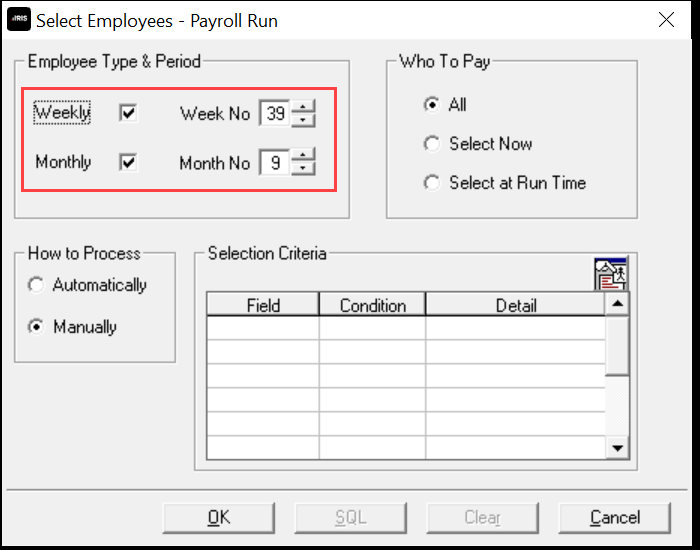

The Employee Type & Period is based on the payroll date.

If you run a two weekly or 4 weekly payroll the weekly period is always the end of the 2 or 4 week period. If your pay date is not in the 2nd or 4th week respectively you will need to manually change the period.

If you run multiple pay frequencies you can deselect the frequency you are not paying.

-

Select OK.

How the payroll calculation works

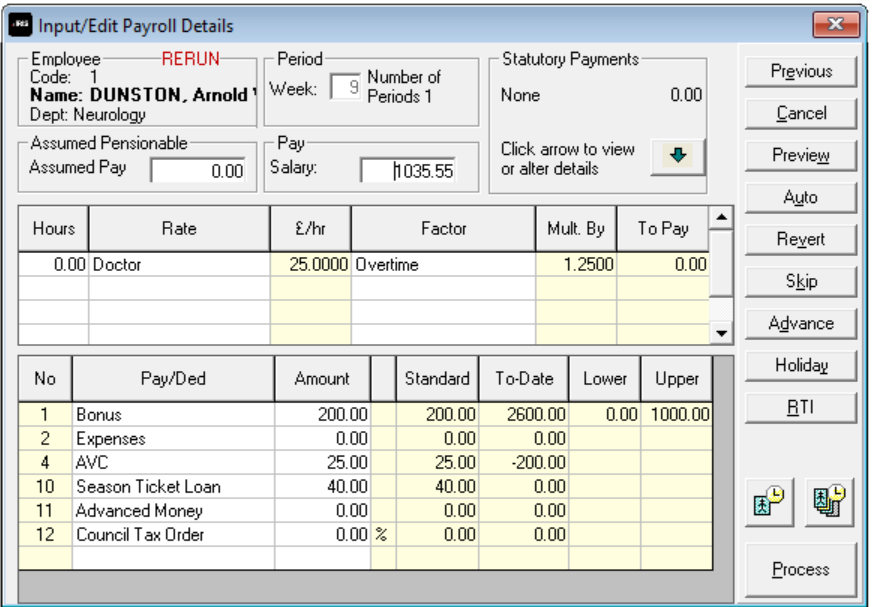

When you first open the payroll calculation screen the software fist checks to see if the period has already been run.

-

If the period has run, it pulls the previous run from the history table in the database.

If you need to make changes to these figures you can overwrite the item, select the revert button or go to the payroll menu and undo the payroll.

-

If the period has not run, it pulls information from the employee record and populates the standard information in the payroll run screen.

Items in the payroll run screen can be amended. Changes made are for this period only. If you want the changes to be permanent, you make the change in the employee record before running the payroll.

-

If you use the IRIS AE Suite™ the employee is assessed and if necessary the pension deduction will be made.

-

If you don’t want to pay the employee, you can process with a 0 pay (so the employee will receive a tax refund if they are due). You can also select advance to move them onto the next pay period.

Do not use skip unless you plan to return to the employee and process or advance for this pay period.

-

Select Preview to view the payslip..

-

To run the payroll for this employee and move to the next, select Process.