- From the Clients menu, select Clients list.

- Change the client list view to either Active clients or a custom view that includes all relevant clients.

- From the Trust tax returns widget on the client dashboard, select Start a new tax return (or Start new if there are existing returns).

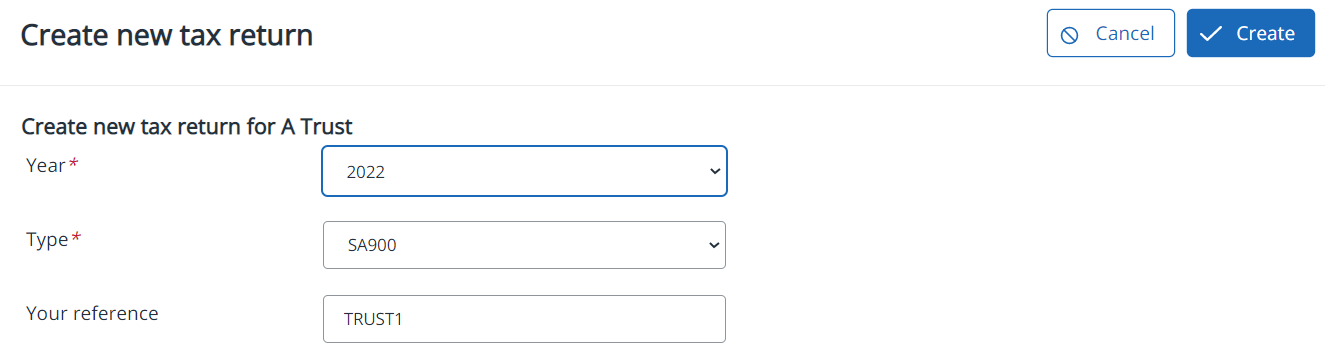

- Select the tax Year from the list. The earliest year supported is 2012.

- Choose the required tax return Type:

- SA900 (default)

- Your reference defaults to the client ID but can be changed.

- Select Create to start the tax return process.

- If a previous tax return already exists, then applicable data is rolled forward from the previous record and the Data Input tab populated.

- Select Add a new section to fill out the tax return. Else, if sections have been automatically added, edit each in turn and adjust as required.

- When complete, review then submit the tax return.

Optional tasks

You can save and return to the tax return at any time before submission:

- Add an attachment

- Check or change the status of tax returns

- Download Tax Pack to view or produce a PDF of the full tax return

Learn how to submit a trust tax return in IRIS Elements Trust Tax

More videos and playlists available in our library.