Once your client has approved the tax return, it is ready to be submitted to HMRC.

Make sure that you have set up a connection with HMRC and stored your HMRC login credentials before proceeding.

The submission process sends the return, along with any attachments, to HMRC via the Government Gateway. HMRC will then validate the return and either accept it or reject it. The validation process can take anything from a few seconds to a few hours, depending on the status of the HMRC servers - processing is normally completed in less than a minute. You can continue working and don't need to wait for the submission process to complete.

-

Go to Clients > Client list and find the required client.

-

From the applicable tax return widget on the client dashboard, select the required return.

-

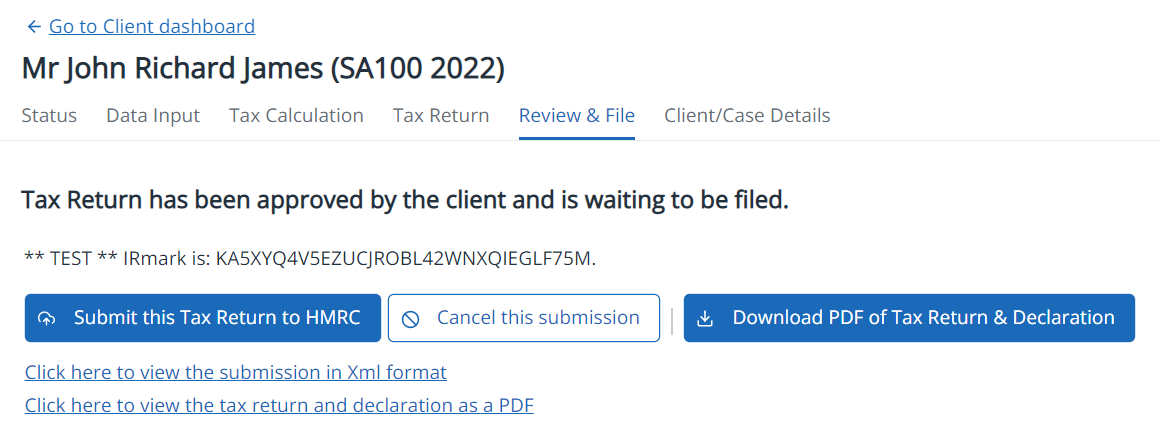

Select the Review & File tab. Select Submit this Tax Return to HMRC.

-

Confirm that you want to submit the return and check the email address that the HMRC confirmation should be sent to. Select Send.

A message is shown indicating that a response from HMRC is pending. This will change once a response has been received. You can then either amend the return or select Download PDF submission receipt to download a range of PDF files. You will also receive an email from HMRC with the response to your submission.

Failed submissions

If the submission fails, a message is shown including the reason why the submission failed. The most common reason is an authorisation failure which can be caused by:

-

incorrect Government Gateway credentials.

-

the tax return has previously been submitted and you didn't tick the box to indicate that you were filing an amendment.

-

some key information is incorrect, such as a UTR that is not recognised, or a company registration number that does not match the one that HMRC have on file.

Check the failure message and take the appropriate action.

Filing Credentials

If your Government Gateway credentials are incorrect, or if the UTR is not recognised, you are likely to immediately receive a failure response. Make sure that you are using the correct credentials for the type of tax return.