Run individual ID checks

You can run ID checks for UK-based individual prospects, clients or non-clients, or you can run bulk ID checks for multiple clients whose ID checks are due to expire.

The current status of the most recent ID check is shown on the

You can view an audit of the changes made to an AML check, for example, if a manual change is made to the risk or next due date is changed. Find out how to View the AML audit.

You're charged a fee for each ID check so make sure that the client information you submit is accurate and correctly formatted to avoid unnecessary costs.

- From the Clients menu, select Clients list.

- Change the client list view to either Active clients or a custom view that includes all relevant clients.

- Open the relevant client.

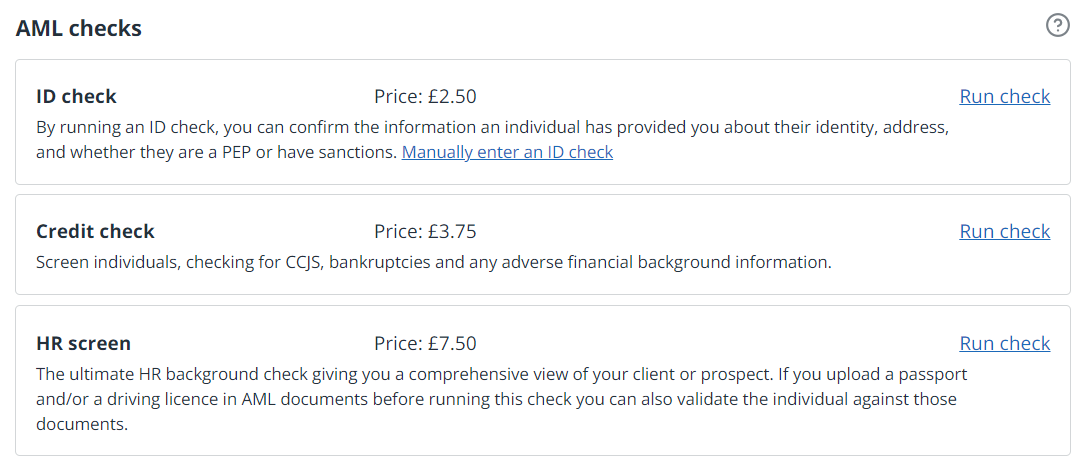

- Select the AML tab. A list of available checks is shown.

You can view the results of any existing checks by selecting the down arrow. Any checks for expired relationships will have a grey background.

You can view the results of any existing checks by selecting the down arrow. Any checks for expired relationships will have a grey background. - In ID Check, select Run check. A warning message is shown if any required data is missing.

A ID check in progress message is shown. You can continue working as normal while you're waiting for the results.

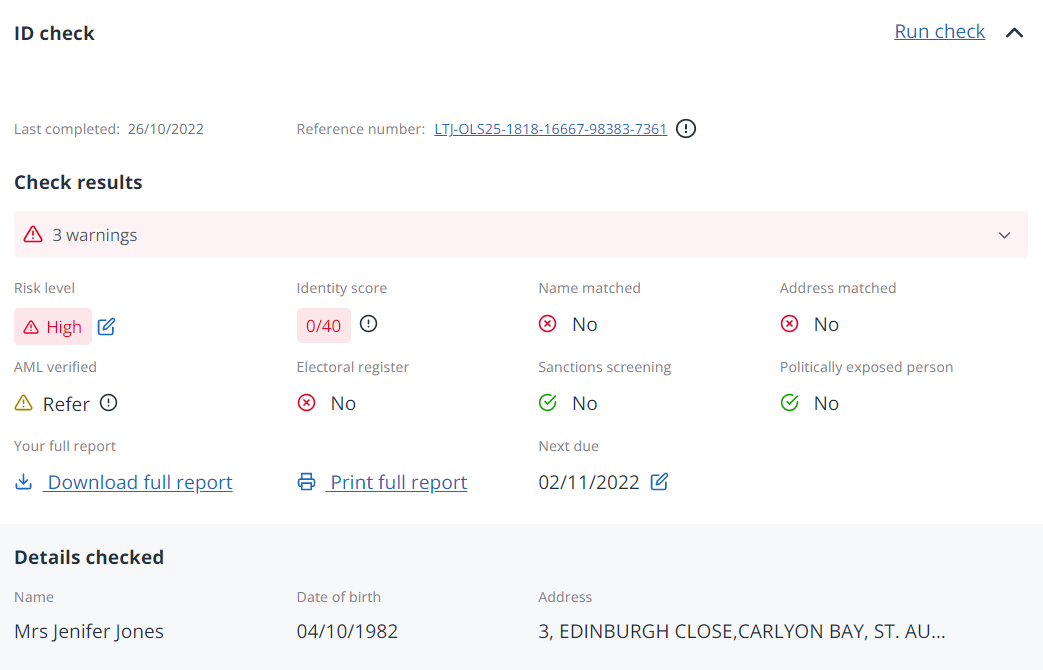

- Once the check has been completed, a summary of the results and a risk level is shown. You can Download full report or Print full report. You can manually edit the Risk level and Next due date.

ID check results

Risk level

When the identity score returned is 40/40, the Risk level is set to Normal and the Next due date is set to 12 months.

When the identity score is between 10/40 and 30/40, the Risk level is set to High.

When the identity score is 0/40, the Risk level is set to High and the Next due date is set to 1 week.

Identity score

This relates to the identity of the individual and is made up of identity match, address match, date of birth confirmed, and at least 2 primary checks. The maximum score is 40 and 10 points are lost for each criteria missing.

For example, identity match, address match, at least 2 primary checks but date of birth not confirmed would return a 30/40 score.

AML verified

This indicates that the individual has met the verification criteria. This is ID, address, date of birth, and two or more primary checks.

Warnings relate to any triggers associated with part of the check. If three or more warnings are returned with the response then regardless of the identity score, the Risk level is set to High and the Next due date is set to 6 months.

Primary checks and SHARE records

Any reference to primary data sets refers to SHARE, Electoral Register, CCJs, or Bankruptcy and Insolvency data.

SHARE records include Loan & Instalment, Mortgage, Revolving Credit & Budget, Telecommunications, Utilities, Home Shopping, Bank, Miscellaneous, Insurance, and Home Credit.

Learn how to run ID checks for individuals in IRIS Elements Anti Money Laundering Checks

More videos and playlists available in our library.