If you need to make any amendments to a return that has already been submitted, you must first cancel the submission.

Cancel the submission

-

Go to Clients > Client List and find the required client.

-

On the Personal tax returns widget on the client dashboard, select the required return.

-

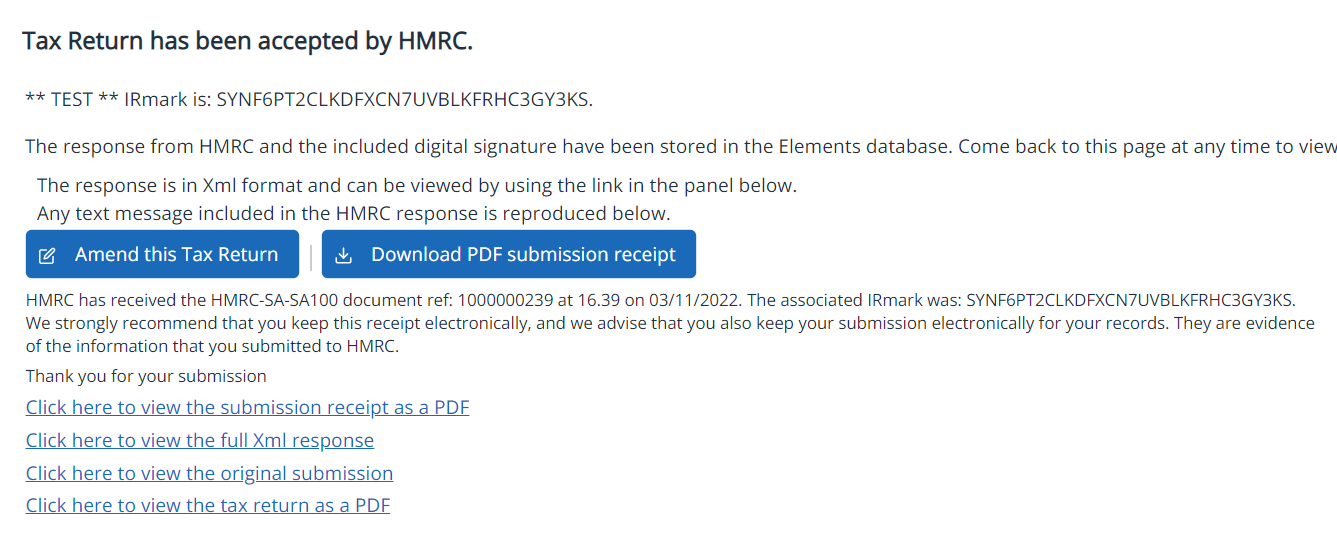

On the Review & File tab, select Download PDF submission receipt to download a copy of the acceptance receipt from HMRC .

-

Select Amend this Tax Return then confirm you want to delete the current submission. The Data Input tab is automatically shown and the tax return status changes to Ready for Review.

Amend the tax return

-

Make the required amendments by selecting the applicable section. You can also add a new section.

-

When you've finished the amendments, on the Status tab, change the Status of tax return to Completed.

-

Select the Review & File tab and correct any warnings or errors as required. Under Filing options, ensure that This is an amendment to previous filing is selected.

-

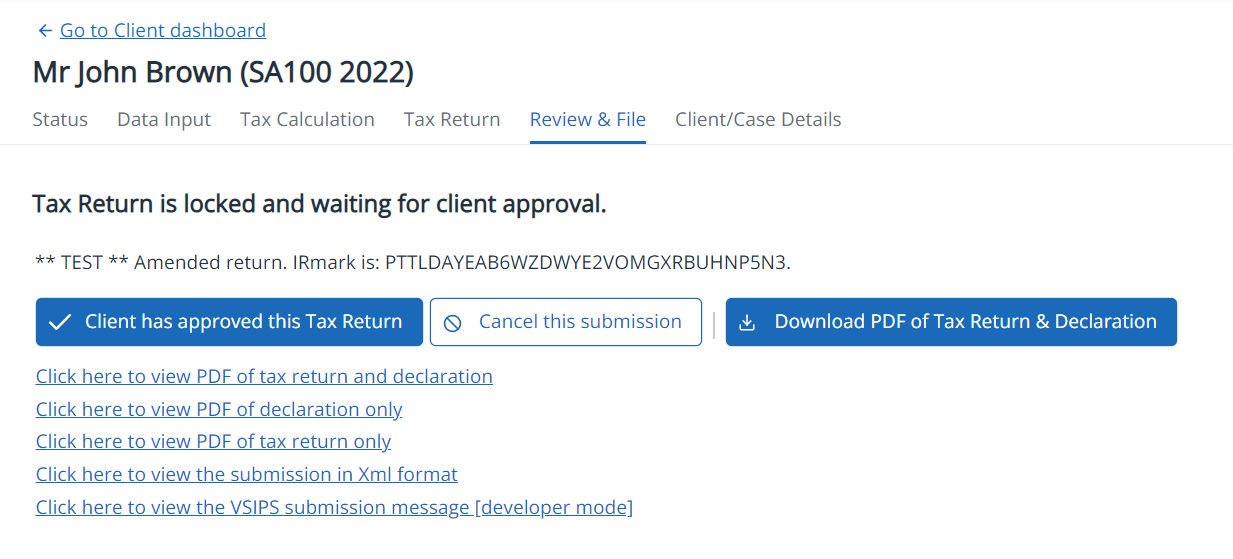

Select Prepare for filing. You can also View XML or Submit TPVS.The amended return is now waiting for client approval.

After obtaining client approval

-

Once you have obtained client approval, select Client has approved this tax return. Additional options are available to view PDFs.

-

Confirm that the client has approved the return, then select OK.

-

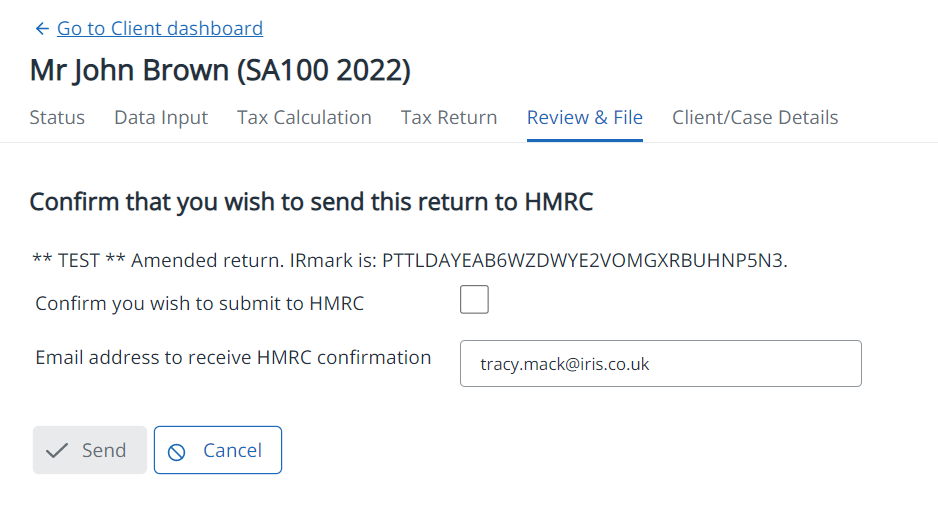

Select Submit this Tax Return to HMRC, then Confirm you wish to submit to HMRC.

-

Select Send. An accepted message is displayed once the return has been received by HMRC.