Once you have completed and reviewed the tax return, you can prepare the return for filing. This changes the status to Ready for client approval. You are then ready to obtain client approval.

-

Go to Clients > Client list and find the required client.

-

From the applicable tax return widget on the client dashboard, select the required return.

-

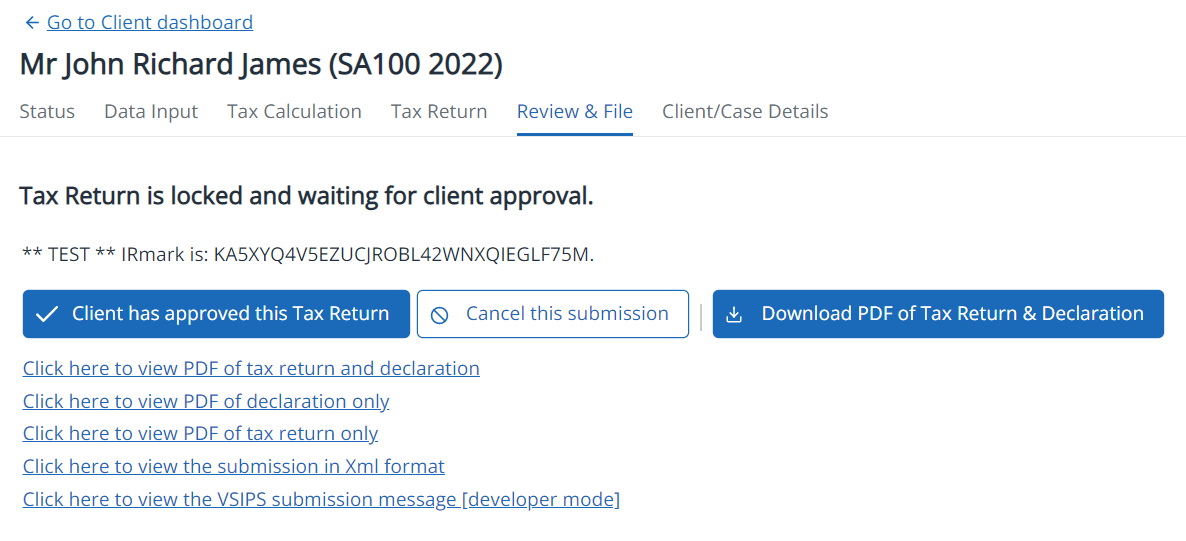

Select the Review & File tab shows that the return is waiting for approval and displays the IRmark.

-

You can view, download and print a variety of PDF documents from this page to send to your cllient. Select Download PDF of Tax Return & Declaration then choose from the following documents:

- The tax return, stamped on each page with the IRmark.

-

A declaration form which the client can sign to approve the submission.

- The tax computation (not available for partnership tax returns).

-

A Summary of Tax Due report (individual and trust tax returns only).

-

Detailed data schedules (individual tax returns only).

-

Once your client has approved the tax return, select Client has approved this tax return. Confirm the consent, then select OK.

The tax return status is changed to Ready to file. You can now proceed to submit the return to HMRC.