Set supplier default VAT rate

In IRIS Elements Cashbook you can set a default VAT rate for each and any supplier. IRIS Elements Cashbook will then use the default VAT you have chosen for all purchase orders, repeat purchase orders and purchase invoices raised.

This can be particularly useful if you deal with a range of suppliers or services that charge VAT at different rates.

Enable default VAT rate for a supplier

-

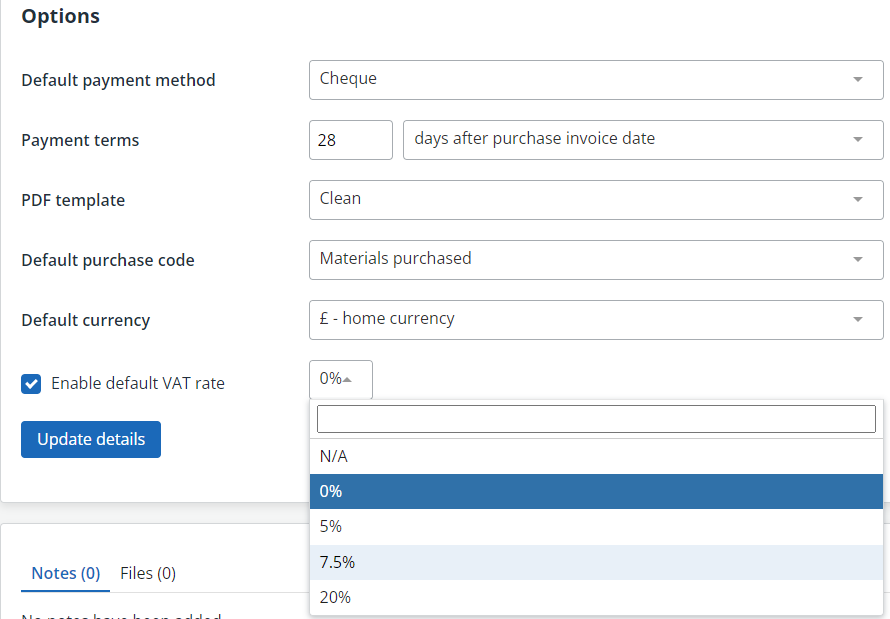

Go to Purchases > Suppliersand select the supplier. Then go to Options.

-

Select Enable Default VAT rate.

-

From the list select a VAT rate to apply to purchase orders and purchase invoices raised for this supplier.

If the VAT rate you want to apply is not available in the list, add it in VAT settings.

-

Select Update details.

Now, when you create a purchase order or purchase invoice for this supplier, the selected VAT rate is auto populated.

This setting will override the rate applied to individual purchase or product nominal codes.