Before processing period 1

Do not start to process year end until after our next release on 11th March 2026. Processing year end before this could cause major errors.

Before processing period 1 of the new tax year, you need to:

-

Make sure you are in period 1 of the 2026/2027 tax year.

-

Set the Apprenticeship Levy allowance for each payroll company and frequency, in Legislation > Apprenticeship Levy Legislation.

Learn more in About the apprenticeship levy.

-

Update, save, and calculate statutory payments in Payroll > employee record > Input, to make sure the most up to date rates are used in payment schedules.

-

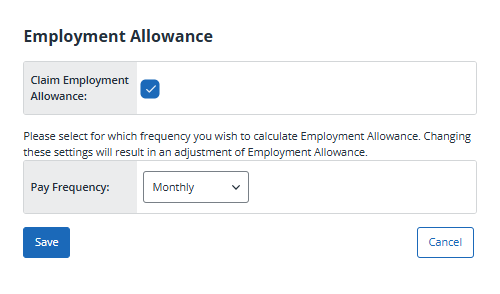

In line with legislation changes, the Employment Allowance configuration is cleared down during Year-End and needs to be reconfigured during period 1.

For tax year 2026/27, Employment Allowance no longer counts as 'de minimis state aid' (financial support from the government), therefore, the option to select the state aid sector has been removed from Employment Allowance Legislation -

Update Maintenance > Legislation > Employment Allowance Legislation.