Use this option to upload a .xls spreadsheet file containing the VAT data.

- From the Clients menu, select Clients list.

- Change the client list view to either Active clients or a custom view that includes all relevant clients.

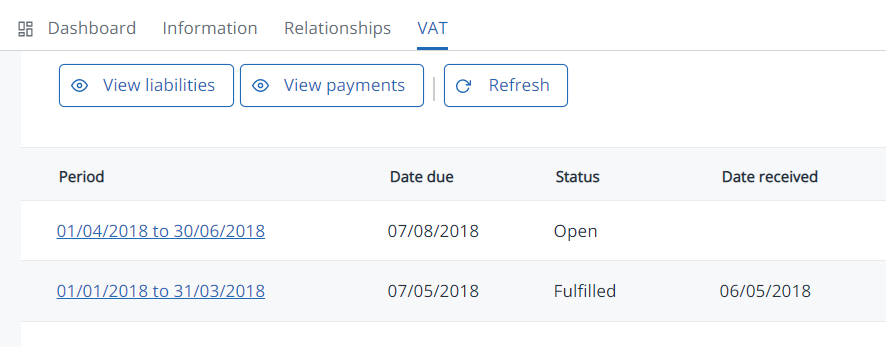

- On the VATtab refresh the data to view any new liabilities, then select the required period.

- Select Upload spreadsheetthen selectChoose file.

- Select the file then selectUpload.

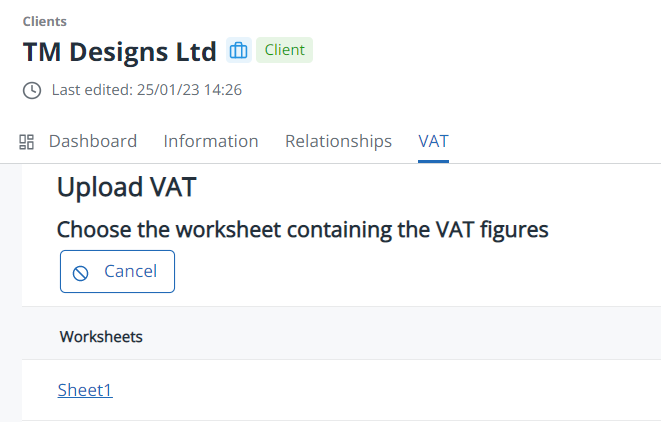

- Select the worksheet that contains the VAT figures.

- The content of the spreadsheet is displayed. Select each cell (that corresponds to the box on the VAT return) that you want to import. Select the box again to remove the selection if you need to. A tooltip provides a description of the type of VAT.

- Once you've selected the data, selectImport values. (If you need to, selectClear selectionto start again orChange worksheetif you've selected wrong sheet in error.)

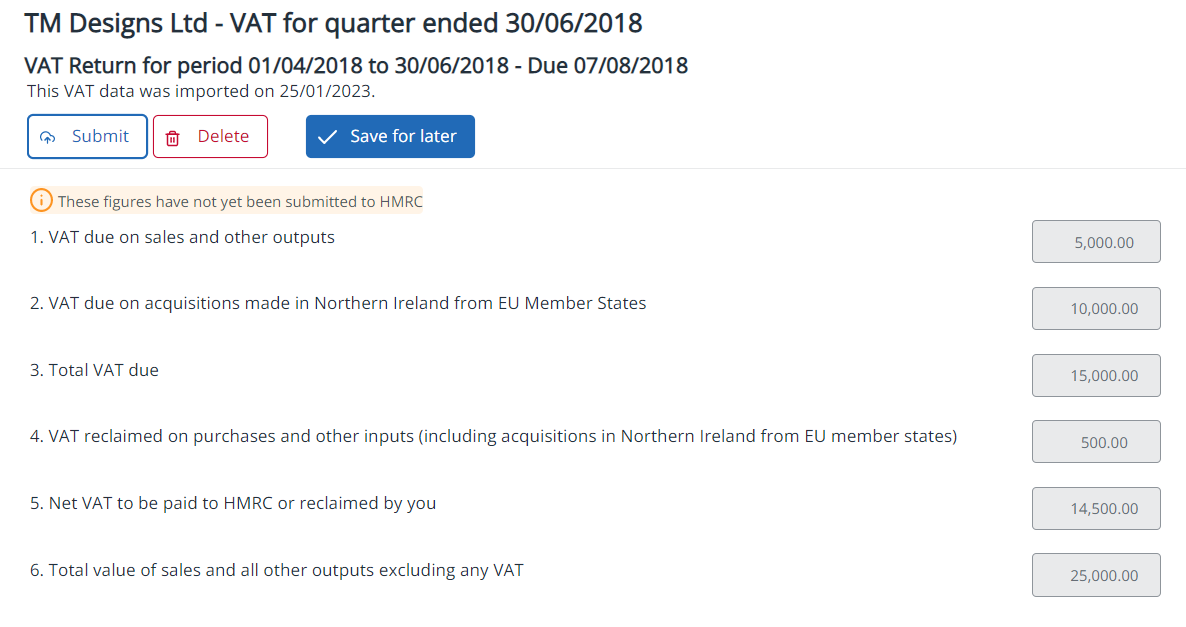

The return is populated with the selected figures and displayed on the next screen.

- Select Save for later, or select Submit if you're ready to submit to HMRC.

Error messages

Rounding errors when importing from Excel

We don't make any changes to the values on a spreadsheet when you upload it. If you receive a rounding error (i.e. the amounts differ by a penny), check your spreadsheet and apply either a TRUNC or ROUND function - the values may appear on the screen to only have two decimal places, but could have more.

Error when Box 5 is a negative value

The value in box 5 must always be a positive value, even if you're expecting a refund. HMRC will pick up that the inputs are larger than the outputs and will process a refund accordingly.