Once you have created a new trust tax return (SA800), you can start to complete the form.

Refer to the HMRC Self Assessment Partnership Tax Return (SA800) guidance if needed (opens in a new tab).

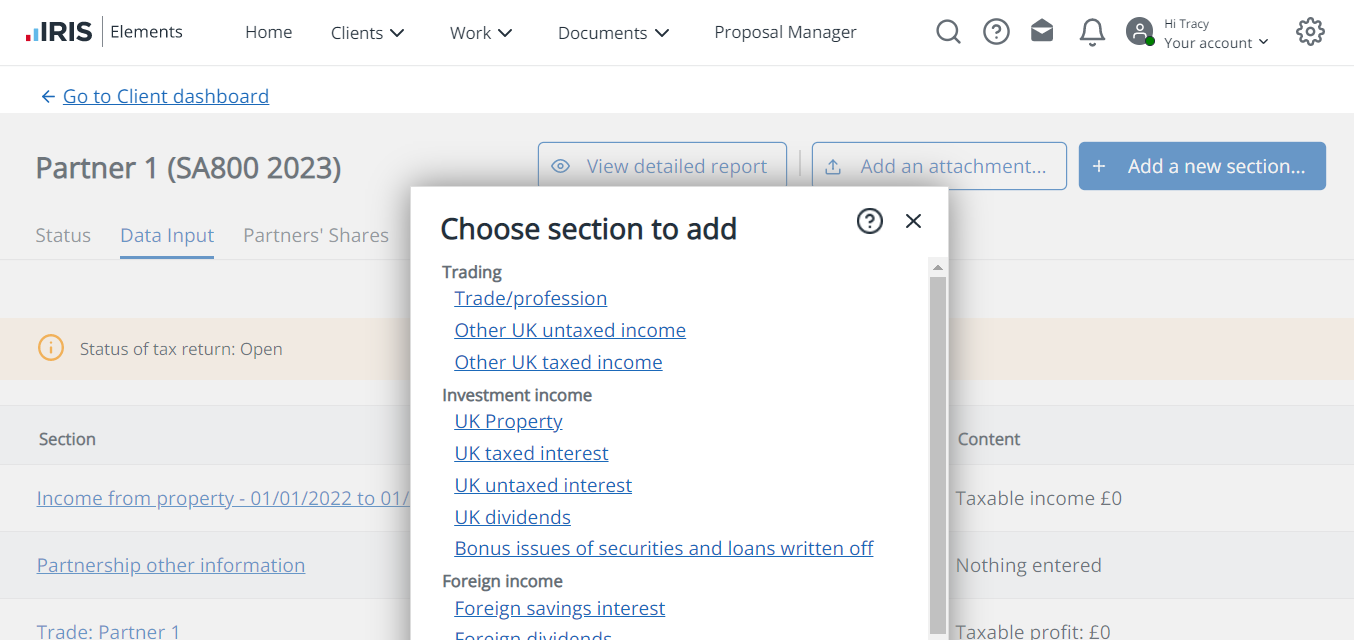

- Open the required tax return, then select the Data input tab.

-

If the required section is listed, select it and skip the next step. If not, select Add a new section.

-

On Choose a section to add, select the required section (any previously added sections are crossed through). Once added, the section can be edited by selecting its name. Find out more about the available sections.

You can also add an attachment or select View detailed report to produce a PDF containing details from the sections completed so far.