Payroll year end process - IRIS Payroll Basics

Step 6: Send your final submissions (FPS and Final EPS)

Employees were paid in the final pay period and statutory recovery made in the final pay period or apprenticeship levy is or has ever been due (even if was subsequently refunded).

The final submission is the one going last to HMRC. We only flag the EPS as the final submission (not the FPS) as the EPS is the last submission for the tax year.

-

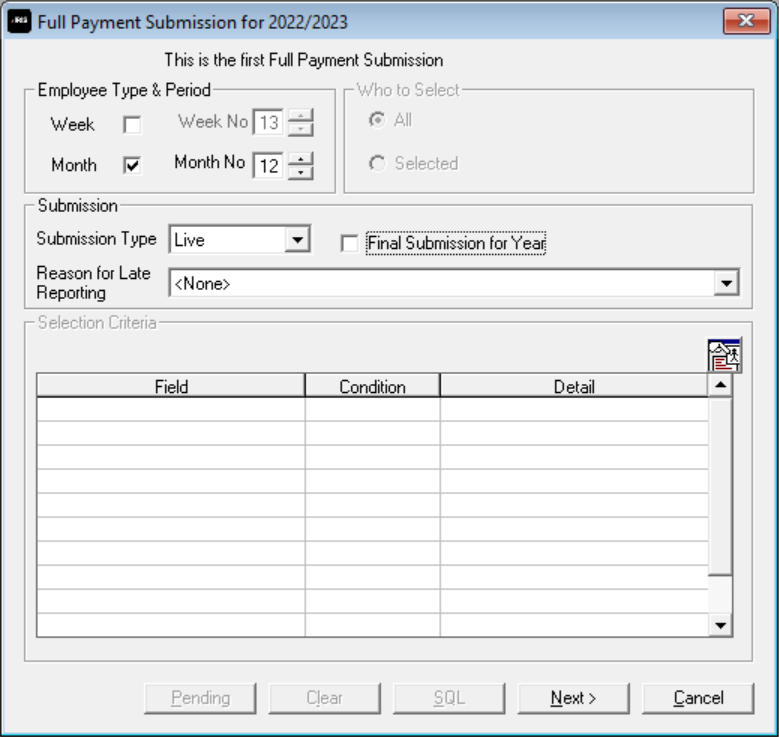

Go to Online Services > Send Full Payment Submission.

-

Select Next.

-

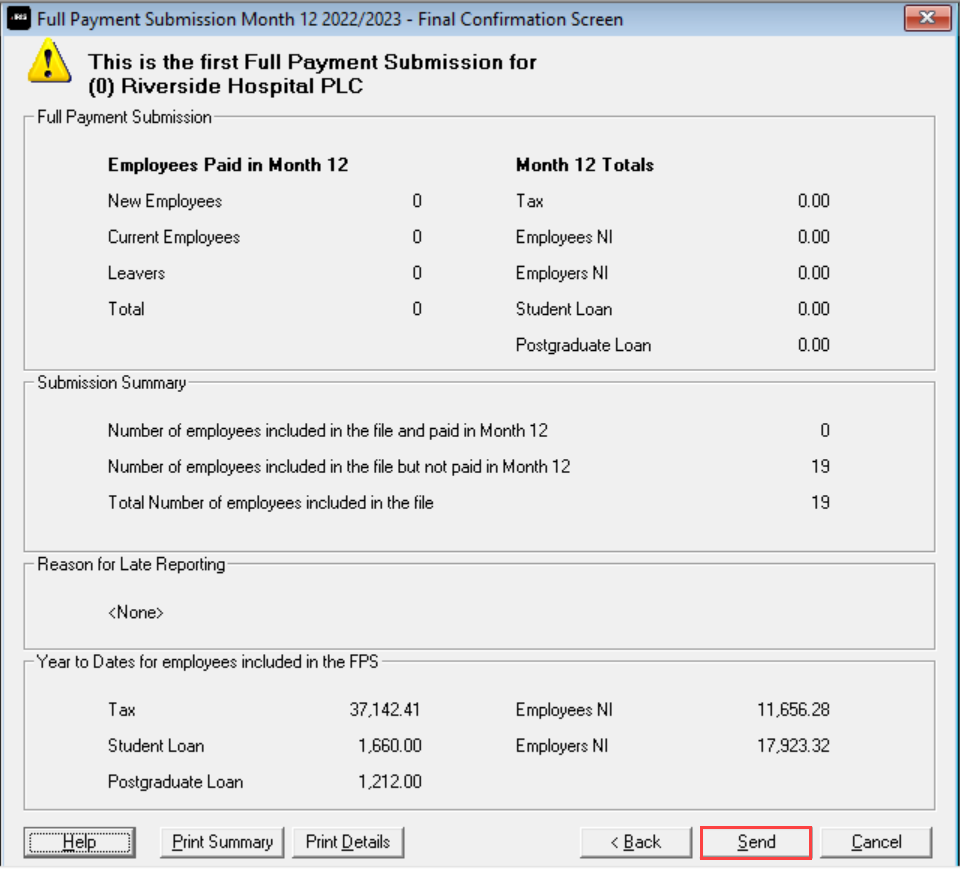

Check the figures on the Full Payment Submission – Final Confirmation screen. Select Print Summary and/or Print Details to print a copy for your records.

-

Select Send.

-

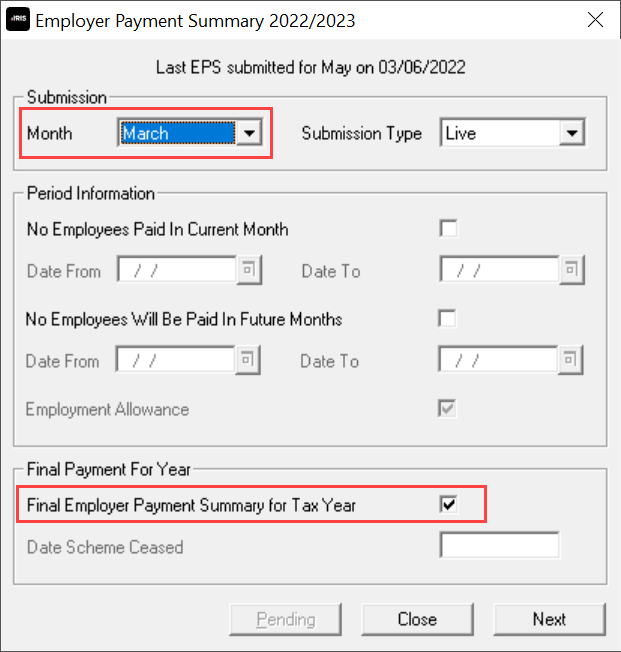

Go to Online Services > Send Employer Payment Summary.

-

Check the month shows March and the Final Employer Payment Summary for the Tax Year is selected.

If March is not selected, you may need to preform Month End Processing. You are prompted to preform Month End Processing if required when you select Next.

-

Select Next.

-

Check the figures on the Employer Payment Summary Values screen and amend them if necessary.

For example: You have employees payed using afferent software. These both have the same PAYE tax reference in each. If you are using IRIS Earnie to submit the final EPS, the EPS values must be combined before submitting.

-

Select Next.

-

Check the values on the Employer Payment Summary – Year to Date Values section. Select Print if you require an EPS Confirmation report.

-

Select Send.

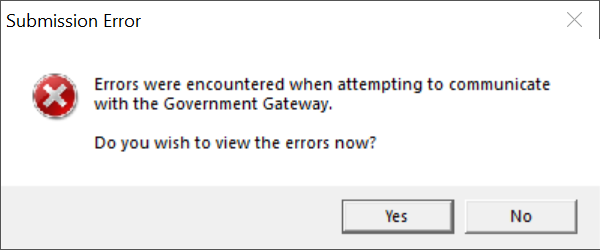

If you receive a Submission Error

Select Yes to get more information and refer to the troubleshooting guide.

| IRIS Knowledge base

IRIS Website |

Legislation guide

Help Centre |

Payroll facts and figures

Help Centre |

HMRC Service Availability

External link |

| Tel: 0344 815 5555 Support |

earniesupport@iris.co.uk Email Support |

Software downloads

IRIS Website |

IRIS 'One Number' guide

Help Centre |