-

Go to Clients > Client List and find the required client.

-

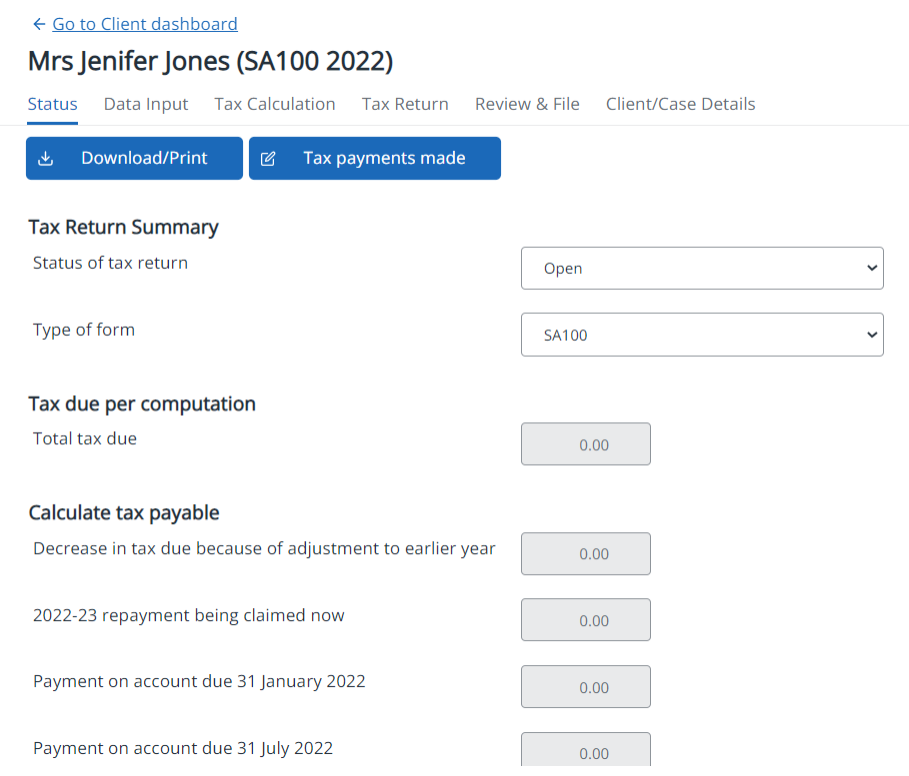

From the Personal tax returns widget on the client dashboard, select the required return. The Status tab is shown by default including a summary of the tax due, and payable for the current tax year.

-

You can change the Status of tax return or change the return form type (SA100 or R40).

Form R40 cannot be filed online. IRIS Elements Tax and Accounts does not produce the SA200 short form.

-

You can download and print a PDF report of the summary of tax due and payable.

-

You can record any payments made on account and balancing payments already made for the current year.

The following additional tabs are available:

Data input - used to complete the data required for the tax return.

Tax calculation - shows the tax calculation and includes an option to download the calculation as a PDF file.

Tax Return - used to preview the tax return and download a PDF copy.

Review & File - used to validate and prepare the tax return for filing. After the return is validated and the IRmark has been generated, this tab allows the download of various PDF files which can be sent to the client. The tab is also used to submit the return to HMRC and shows HMRC submission messages.

Client/case details - shows details of the client and tax return which can be edited (where available).

Tax return summary information

Shows the tax due or overpaid for the tax year, before taking into account adjustments and payments on account.

Shows any adjustments to the tax payable, along with any payments made and any amounts to be collected via PAYE.

Shows the calculated payments on account and any claim to reduce payments on account that have been made.

Shows the total tax payable on each of the due dates for January and July.