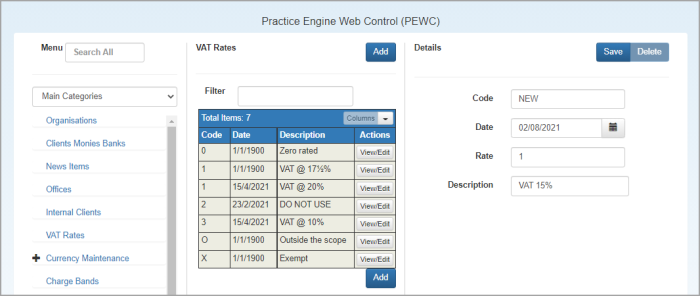

Maintain VAT rates

IT Manager Practice Admin

If a tax rate needs to be updated to reflect a new rate, a new rate should be added using the same Code but a new effective date and rate. Do not amend the existing rate as this will affect any existing unposted entries and any credits that are applied.

-

Select Admin > Categories from the menu.

-

Select Main Categories from the list, then select VAT Rates.

-

Click Add (or View/Edit to edit an existing category).

-

Enter a code to be used for the tax rate, ensuring that the default rate has a code of 1.

-

Select the Date the rate should come into effect.

-

Enter a Description which will be the title displayed in the applicable drop-down list, then enter the default hours for each day of the profile.

-

Click Save.