How to submit an EPS

-

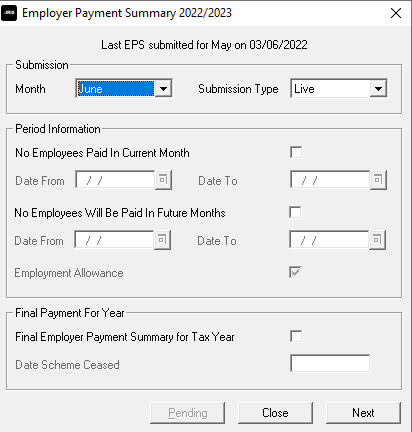

Go to Online Services and select Send Employer Payment Summary.

-

Select the relevant Month.

-

If you are submitting an EPS because you are not paying any employees this month, select the No Employees Paid In Current Month box and enter the relevant dates.

-

If you are submitting an EPS because you are not going to be paying any employees in future months, select the No employees will be paid in Future Months box and enter the relevant dates.

-

If this is the final EPS for the tax year, select the box.

-

Select Next.

-

This screen shows the year-to-date amounts for each month, as required for the EPS. The Current Month row contains the amounts calculated for this month.

These will be added to the year-to-date values and submitted. If you need to alter these figures, for example, for any other payrolls with the same tax reference, you can do so by typing into the relevant boxes.

-

When you are happy with the Current Month values, select Print . If you need a hard copy of the figures, select Next.

-

Select Back if you want to amend anything and Send when finished.

Anyone using the software mid-year must add Statutory Payment year-to-date values. Go to Company | Alter Company Details, and on the Company tab, select Payment Summary. Here you can enter the year-to-date values in the month before using the payroll software. For instance, if you started using the software in July, enter the year-to-date values for June in the June row. These values will then populate on the EPS screen.

After completing month-end and sending the EPS, you may need to recalculate the payroll. If so, redo month-end processing, enter the new values onto the EPS screen, and resubmit.