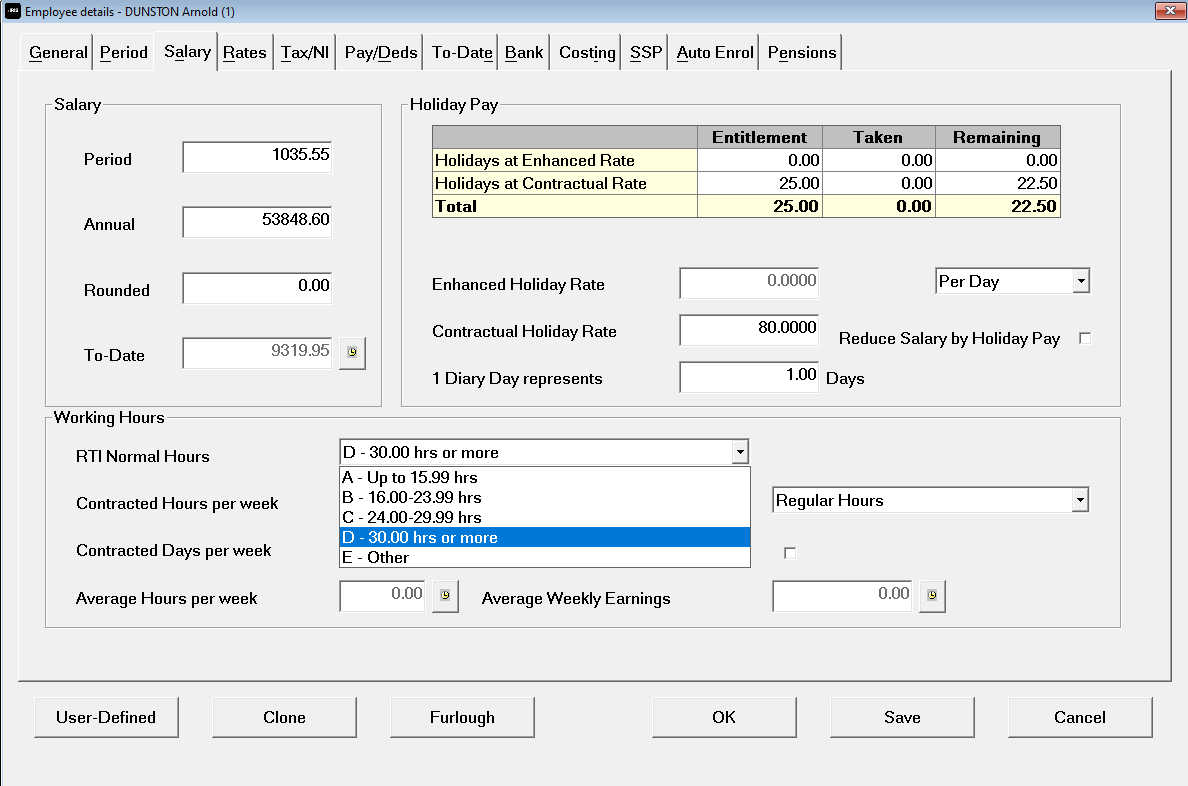

Working Hours

You must provide accurate employee data in your RTI submission. To ensure your data is accurate, go to Employee Details> Salary, and complete the Working Hours section to show the normal hours an employee works in a week.

Normal hours are not always the same as contracted hours and require calculation.

Refer to HMRC's explanation of working hours for more information. It also provides an explanation of how to work out usual weekly working hours. Completing this section is necessary, as HMRC use it when calculating eligibility for tax credits.

The system operates the following bands of hours: A - up to 15.99 hrs, B – 16.00-23.99 hrs, C - 24.00-29.99 hrs and D - 30.00 hrs or more. Select E - Other if you are paying a pension.