About Employee verification connector (EVC)

Once Employee data is in EVC, each financial application an employee makes via Experian and Equifax report requires the employee to provide specific consent before their data can be queried in EVC to support the application. This ensures they retain full control over who receives their data.

Bureau customers: As part of the GDPR, your customers need to understand what is happening with their data. You need to inform your customers of what the service is and how it can impact their employees. The employee and employer fact sheets can help with this.

Should your clients not wish to take the service they can opt out, either in bulk or at an individual level. See opt-out process per IRIS software product release notes

We have partnered withExperian and Equifax for employees whose payrolls are processed by IRIS Payroll software for instant verification of income and employment status.

Traditionally, financial service providers ask for PDF payslips and other documents, to verify employees when considering the application for financial products, such as mortgages and personal loans.

We have integrated an Employee verification connector (EVC) into IRIS Payroll software to remove the manual processes.

Data is shared under the terms of the General Data Protection Regulations (GDPR), Experian and Equifax is authorised and regulated by the Financial Conduct Authority.

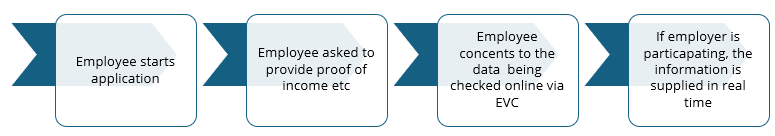

This is how the process works:

Read the full press release | Employer fact sheet (PDF) | Employee fact sheet (PDF) | IRIS Privacy & Data protection policy | EVC Privacy & Common questions | Terms and conditions | Data processing terms