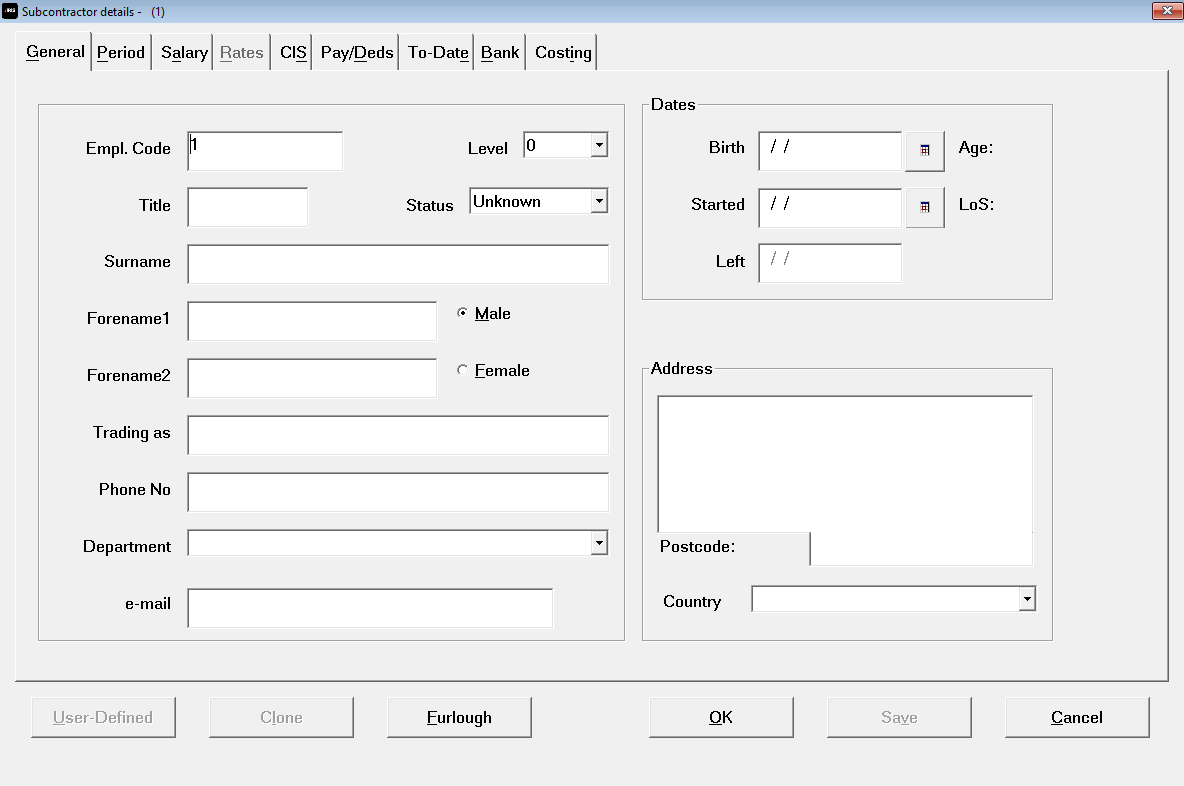

Adding Subcontractors to the Payroll

To start entering your Subcontractors into the system:

-

Select the ‘Employee’ menu and select ‘Add New Employee’. This will open a blank Subcontractor Details screen.

Enter as much information here as you can. You must complete the Trading As field in addition to Forename1 and Surname.

-

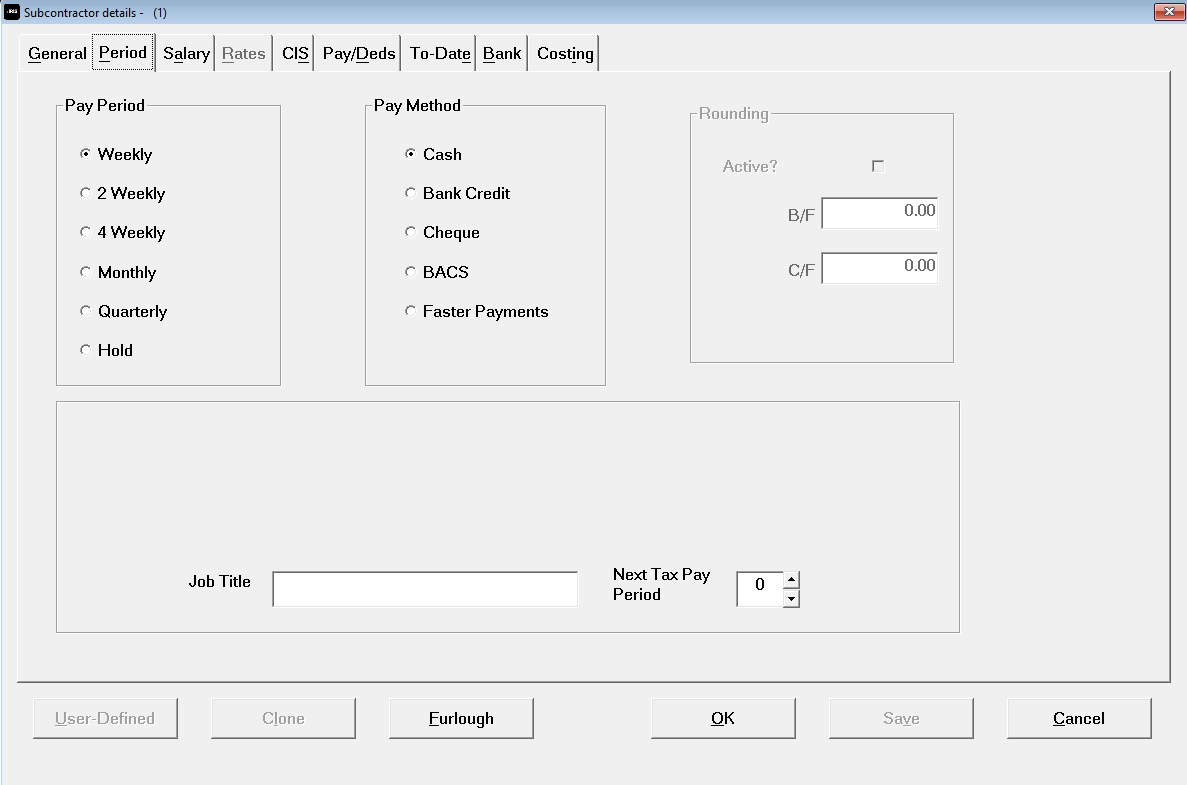

Now select the Period Tab.

-

Enter the frequency you will be paying the subcontractor and the Pay Method. Make sure the Next Tax Pay Period is set to the first week or month you will be paying.

-

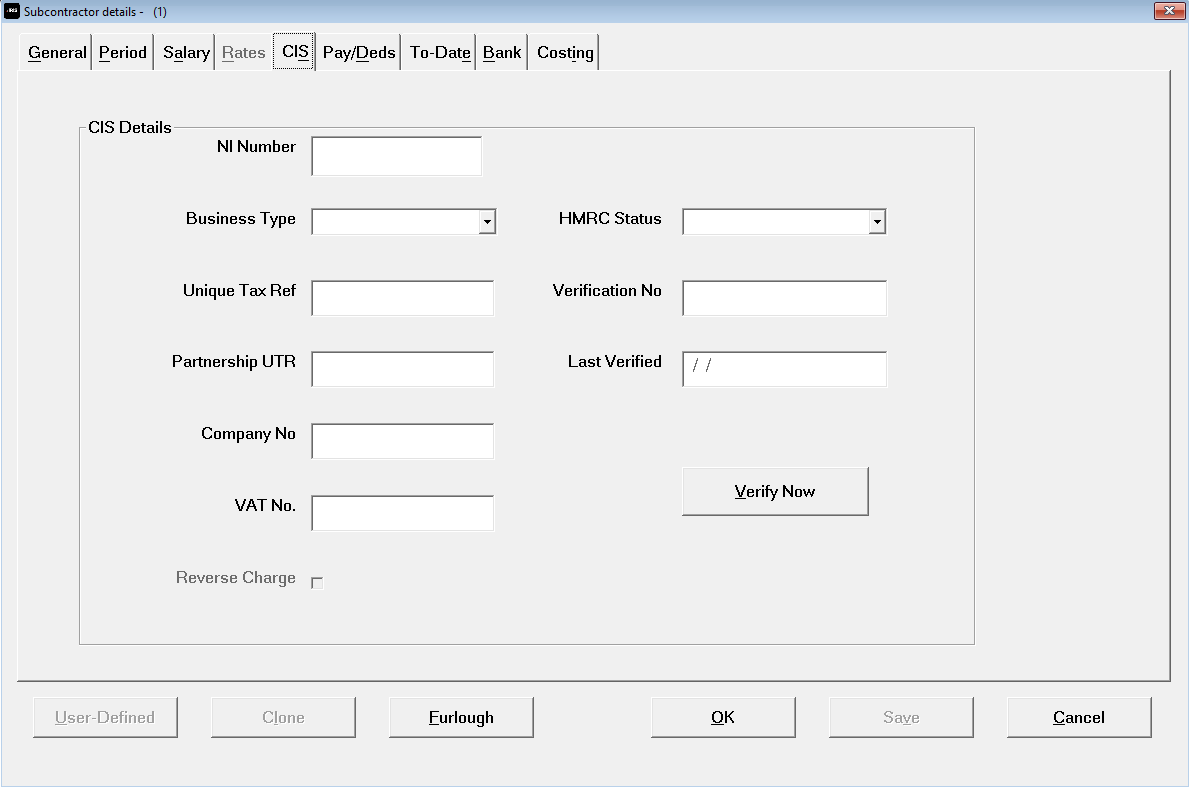

Now select the CIS tab.

This screen holds the information you need to verify your subcontractor with HMRC.

-

NI Number - The subcontractor’s National Insurance Number (if they are a Sole Trader or Partnership).

-

Business Type - This is a drop-down list of the possible business types for subcontractors.

The choices are:

-

Vat No - Anything entered in this field will trigger the VAT calculations in the system. There is no automatic check on the format because there is no European standard so make sure you enter it correctly.

-

HMRC Status - This is received from HMRC and relates to the rate at which you should deduct tax from the subcontractor. It is a drop-down list with the following choices:

-

Unmatched - tax will be deducted at 30%.

-

Matched (Gross) - no tax will be deducted.

-

Matched (Net) - tax deducted at 20%.

If you already have this information you can enter it manually.

-

Verification No This number is received from HMRC when you verify your subcontractor. If you already have this information, you can enter it manually.

-

Verify Now - This is the option to select when you want to verify your subcontractor with HMRC over the internet.

-

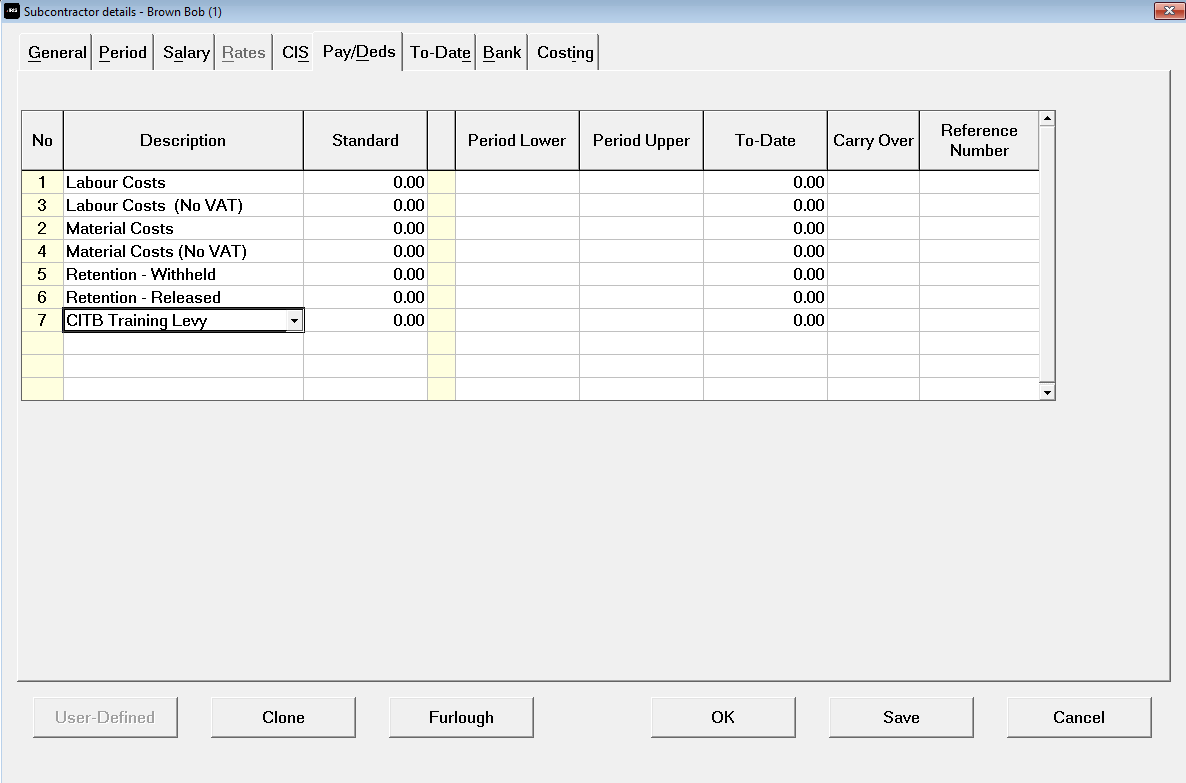

Select the Pay/Deds tab.

If you have any standard amounts you pay or deduct from this subcontractor, this is where you set them up so they always appear in the payroll run. You don’t need to enter a Standard if the amount often changes. You will be able to enter amounts in the payroll run screen.

-

Select an empty box in the description column and then select the drop-down arrow to bring up a list of all the Payments and Deductions you have set up at Company level. You can then select those that you want to use for this subcontractor.

-

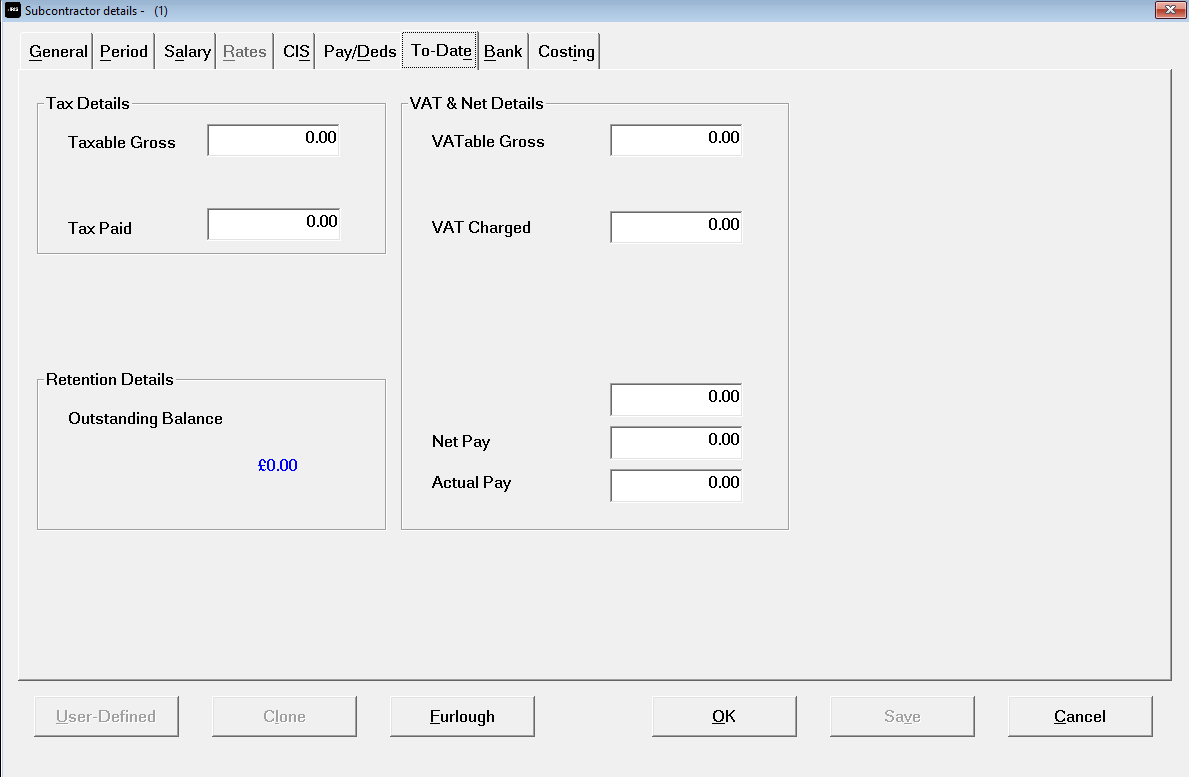

Now select the To-Date tab.

If you have already paid this subcontractor in the current tax year you may wish to enter in amounts paid and tax paid on this tab card. If you haven’t paid them in the current tax year or they are new subcontractors, leave this card blank.

If you choose to retain payment using the Retention – Withheld deduction the system will keep a running total for you and display it here.

-

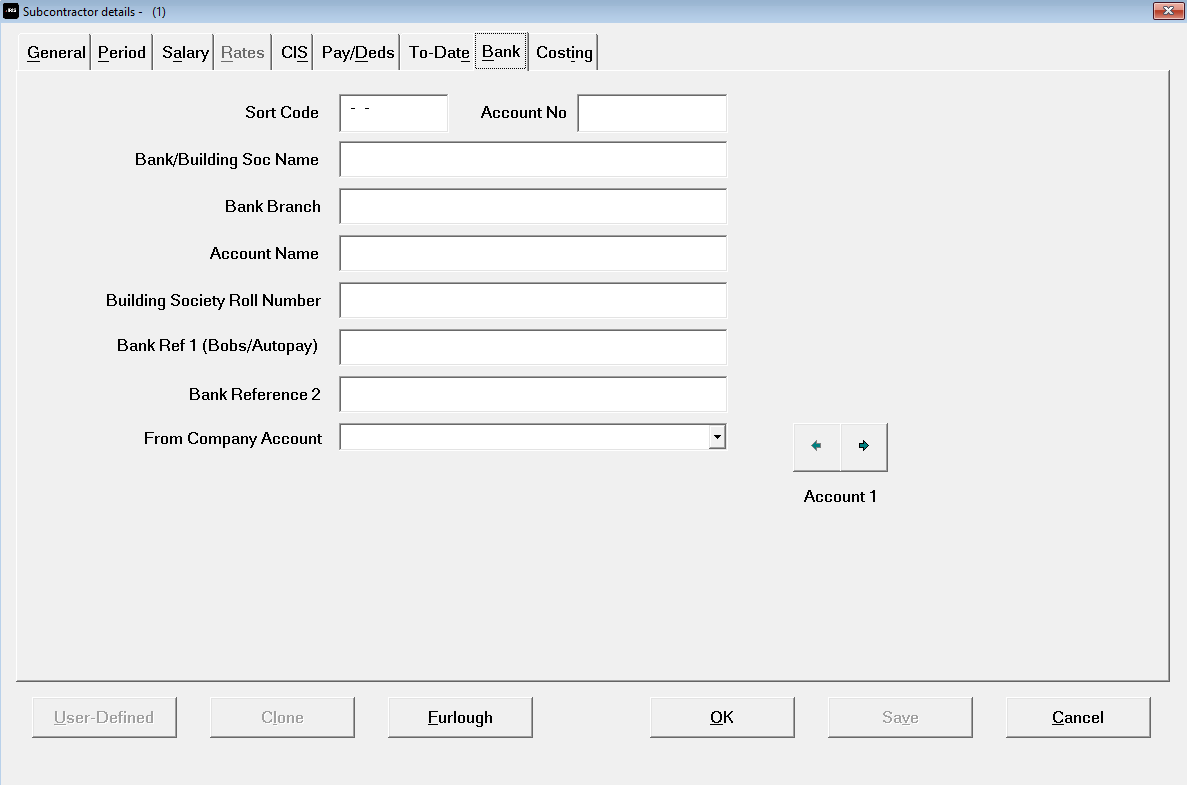

Now select the Bank tab.

If you are paying your subcontractor by BACS, you need to enter their bank details on this tab card and select which of your company bank accounts the money is to be taken from.

-

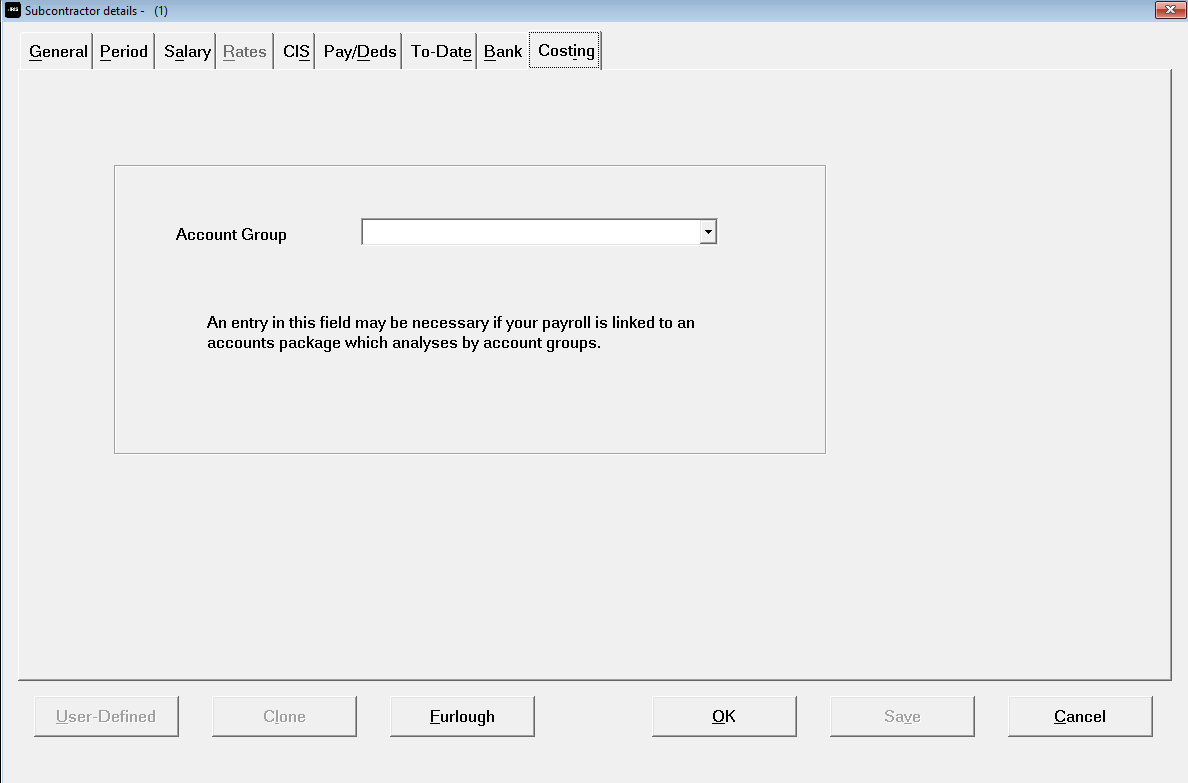

Now select the Costing tab.

-

What you see on this tab card will depend on whether you have the Costing module and how you have your Accounts link set up. You may have to select an Account Group or enter in more detailed Analysis level information.