Month End Online Submission

Month End Summary and Month End Processing

In a CIS Company, you must send your returns to HMRC online every month. To do this: Install the Month End Summary (CIS Only) report:

-

On the ‘Reports’ menu, select ‘Library Selection’.

-

Go to Summaries and highlight Month End Summary (CIS Only).

-

Choose the Select button and then OK.

This report shows:

-

Employee Code

-

Employee Name

-

Unique Tax Reference

-

Employment Status

-

Gross Pay

-

Materials

-

Tax

-

VAT

-

Net

To print the report:

-

On the Reports menu, select ‘Month End Summary’.

-

If prompted, make sure you select ‘Month End Summary (CIS Only)’ from the list.

-

Select the current Month and choose ‘OK’.

-

Select ‘Print’ to send the report directly to the printer, or ‘Preview’ to view it on screen first.

You can print directly from the Print Preview screen by selecting the printer icon at the top of the window.

-

After your report is printed, or after you select ‘OK' on the Preview window, you will see the Month-end Processing pop-up.

We recommend you check you are completely certain that the details are correct before responding ‘Yes’ to Month-end processing. You can only make one return per month per Unique Tax Reference. You can print your Month-end Summary report as many times as you like for the current period if you select No each time you see this message.

-

Select ‘Yes’ if you have completely finished the pay period. Choose ‘No’ if you still have adjustments to make. You will see a Month-end Processing Cancelled message.

-

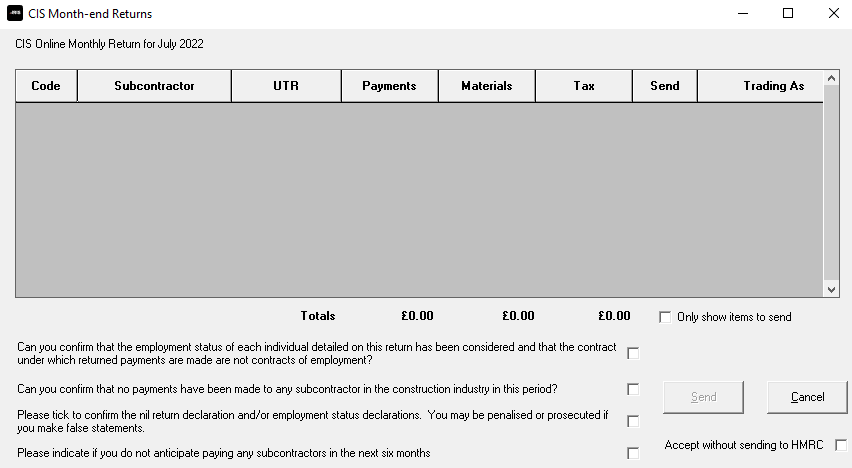

Selecting ‘Yes’ will bring up the CIS Online Month-end Return window.

-

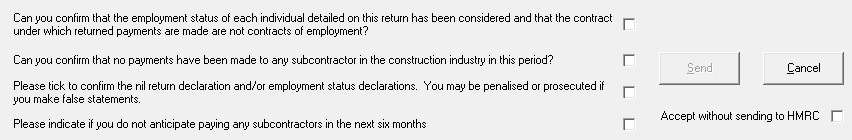

There are three confirmations you have to select before you can send:

-

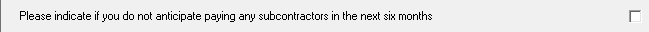

There is also a fourth statement:

Select the fourth box if you will not be paying any subcontractors in the next six months.

If you do not select this fourth box, you MUST send nil returns for each month that you do not pay any subcontractors.

-

Choose ‘Send’ to make your online return. Earnie will connect to HMRC’s gateway and send the information.

You will receive detailed warnings if there are any problems. Once you have made a successful return you will not be able to make the return again for that month.