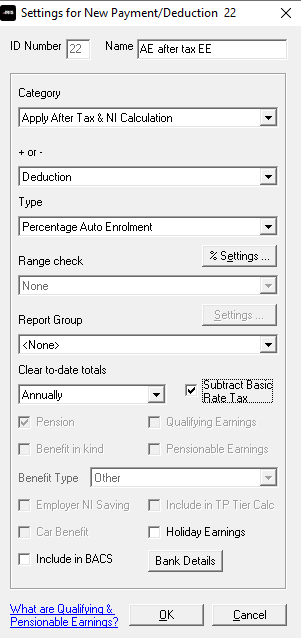

Add Employee Pension Deduction

-

Go to the Company menu and select ‘Alter Payments / Deductions’.

-

Select ‘Add New’.

-

Choose ‘No’ to the message asking if you want to use the wizard.

-

Enter a Name for the pension deduction.

-

In the Category field, select ‘Apply After Tax & NI Calculation’/

-

In the + or - field, select ‘Deduction’.

-

In the Type field, select ‘Percentage Auto Enrolment’.

-

Range check should be the default of ‘None’.

-

Report Group should be the default of ‘<None>’.

-

When Clear Totals field is set to ‘Annually’, during Year-end Restart the year to-date total for this pension deduction will be cleared along with other year to-date totals.

-

Select the ‘Subtract Basic Rate Tax’ box.

-

Select ‘OK’.