Static Data screens

The screens in this category contain fixed information that will not necessarily change from month to month.

|

Screen |

Information |

|

Actions |

Are actions you have inserted open or completed? |

|

Bank |

Do all employees have a sort code and account number? |

|

Car & Fuel |

All car information (if this exists in Payroll) |

|

Court Orders |

Order amount, amount paid and period amount |

|

Future Payments |

Future dated parental leave payments |

|

General Ledger Splits |

Percentage of costs split over multiple departments |

|

Home Address |

Employees’ address details |

|

Main |

All static data (for example, gender, NI number, date of birth) |

|

Manual Tax & NI |

Have automatic tax and NI calculations been overridden? |

|

National Insurance Changes |

Employees’ new NI category |

|

NI Details |

Gross NIable YTD, Directors NI Flag and calculation method |

|

NI Records |

Earnings between thresholds, total year to date (YTD) contributions |

|

P45/Checklist |

Tax code, total pay and tax to date, week/month number |

|

Pay Elements |

Elements assigned to employees, loan amount and loan paid amount, fiscal YTD and user YTD, start and end dates, rate values and standard values |

|

Pay Record |

Department, FTE, grade, spinal point, general ledger (GL) template |

|

Payment Calendar |

Active pay periods (where relevant) |

|

Pensions |

Scheme name, date joined, percentages, values, amount to date |

|

Real Time Information |

Pay ID (HMRC), seconded employees, BACS hash code |

|

Shared Parental Pay |

Average weekly earnings (AWE), partner’s details, expected week of childbirth (EWC), amount to date, weeks paid etc |

|

Split Payment |

Details of the bank account that part of the salary is to be paid into |

|

Statutory Adoption Pay |

AWE, EWC, amount to date, weeks payable, weeks paid, date of birth etc |

|

Statutory Maternity Pay |

AWE, EWC, amount to date, weeks payable, weeks paid, date of birth etc |

|

Statutory Paternity Pay |

AWE, EWC, amount to date, weeks payable, weeks paid, date of birth etc |

|

Statutory Sick Pay |

Qualifying days, SSP amount to date, weeks this PIW |

|

Tax Details |

Gross pay, taxable pay, tax code, tax code changed date, tax to date, this employment figures and previous employment figures |

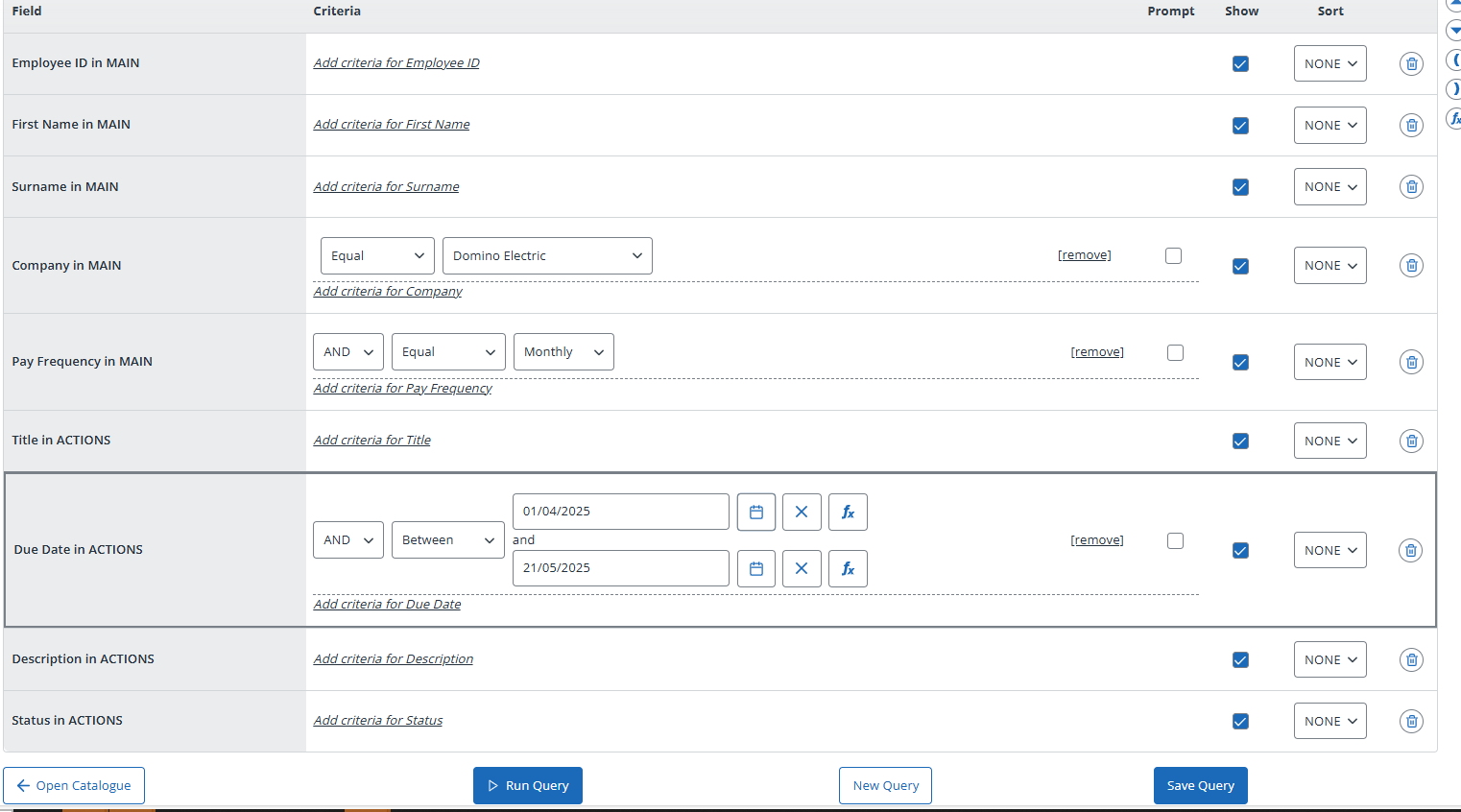

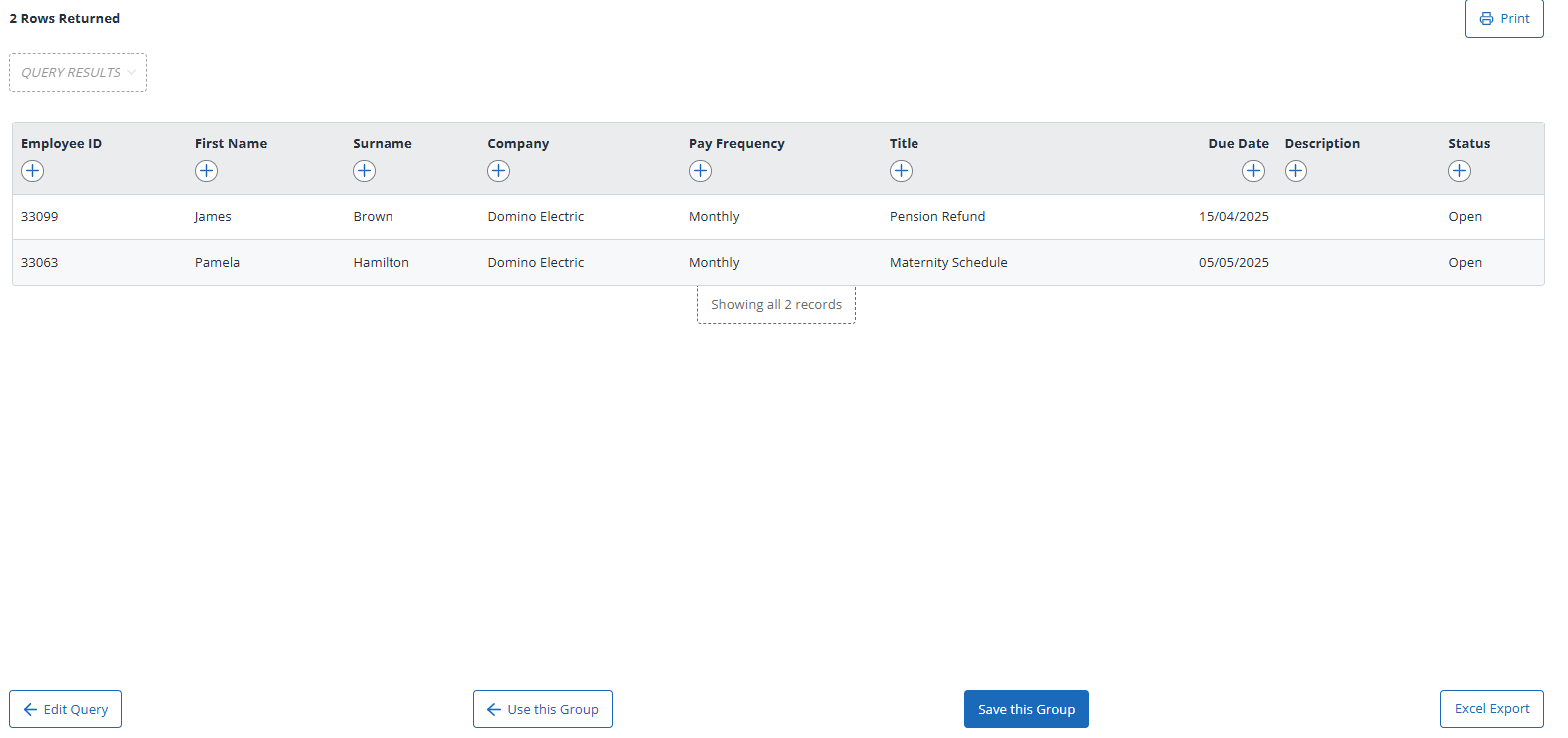

Static Data example query 1: Employee Actions

As part of the CPMS process you can add actions against employees, to be processed through Payroll during specific pay periods. When the CPMS team action the requests, they are marked as Completed. This query is designed to show you any items that have not been actioned, so that you have full visibility.

When you have selected the fields and criteria by clicking Details > Action , click Run Query at the bottom of the screen. You will see the Query Results screen.

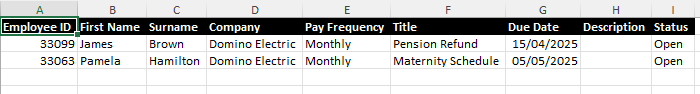

If you cannot see all the results clearly on the Query Results screen, you can click Excel Export at the bottom of the screen to export them to a Microsoft Excel spreadsheet.

If you cannot see all the results clearly on the Query Results screen, you can click Excel Export at the bottom of the screen to export them to a Microsoft Excel spreadsheet.

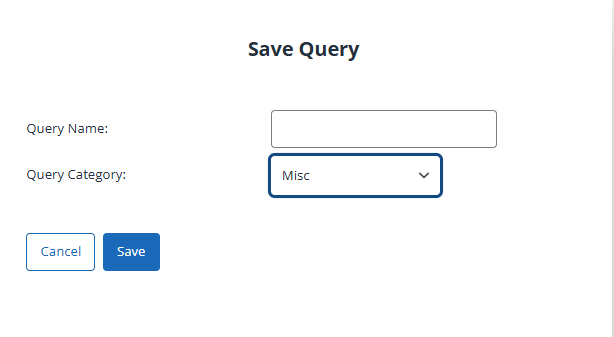

To save the query, click Save Query at the bottom of the New Query screen. You will see the Save Query screen.

Type a name for the query, and then select the catalogue category for the query, from the drop-down menu.

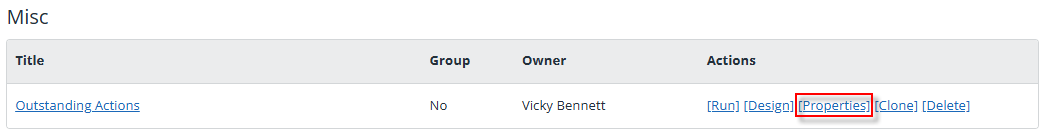

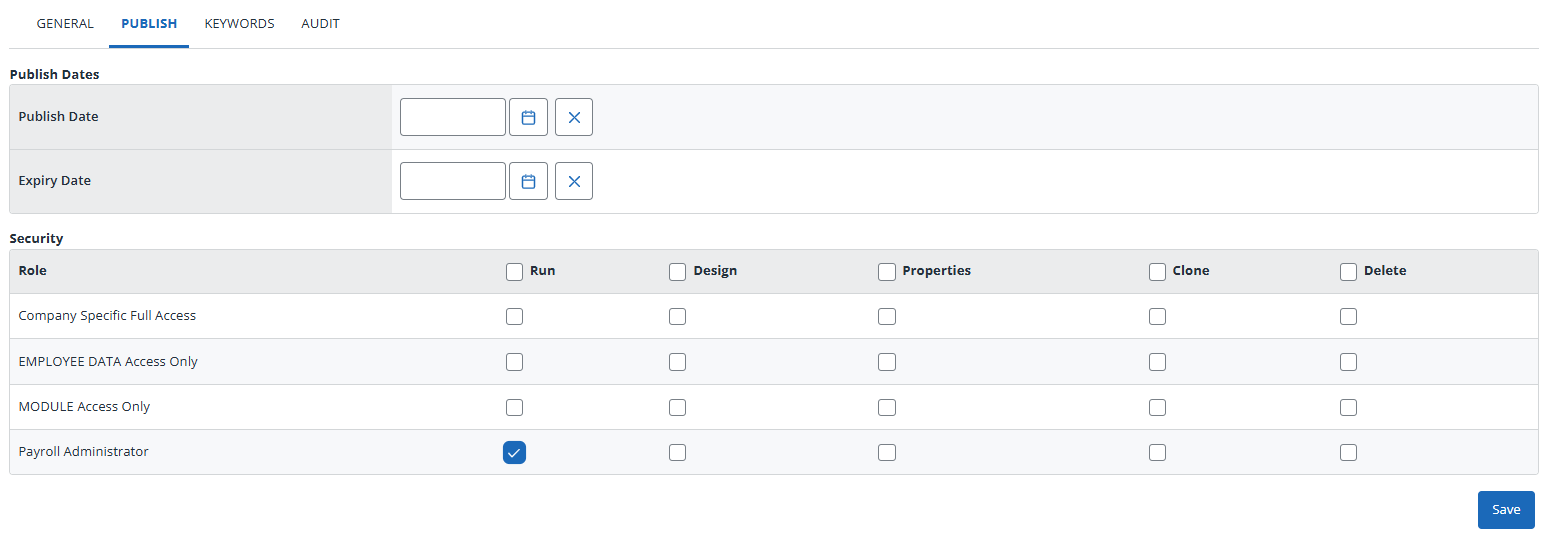

If you want other users to be able to run this query, you need to publish it to the appropriate role. To do this, find the query in the catalogue, and then click Properties in the Actions column of its entry.

On the Properties screen, click the Publish tab, and then tick the appropriate role.

On the Properties screen, click the Publish tab, and then tick the appropriate role.

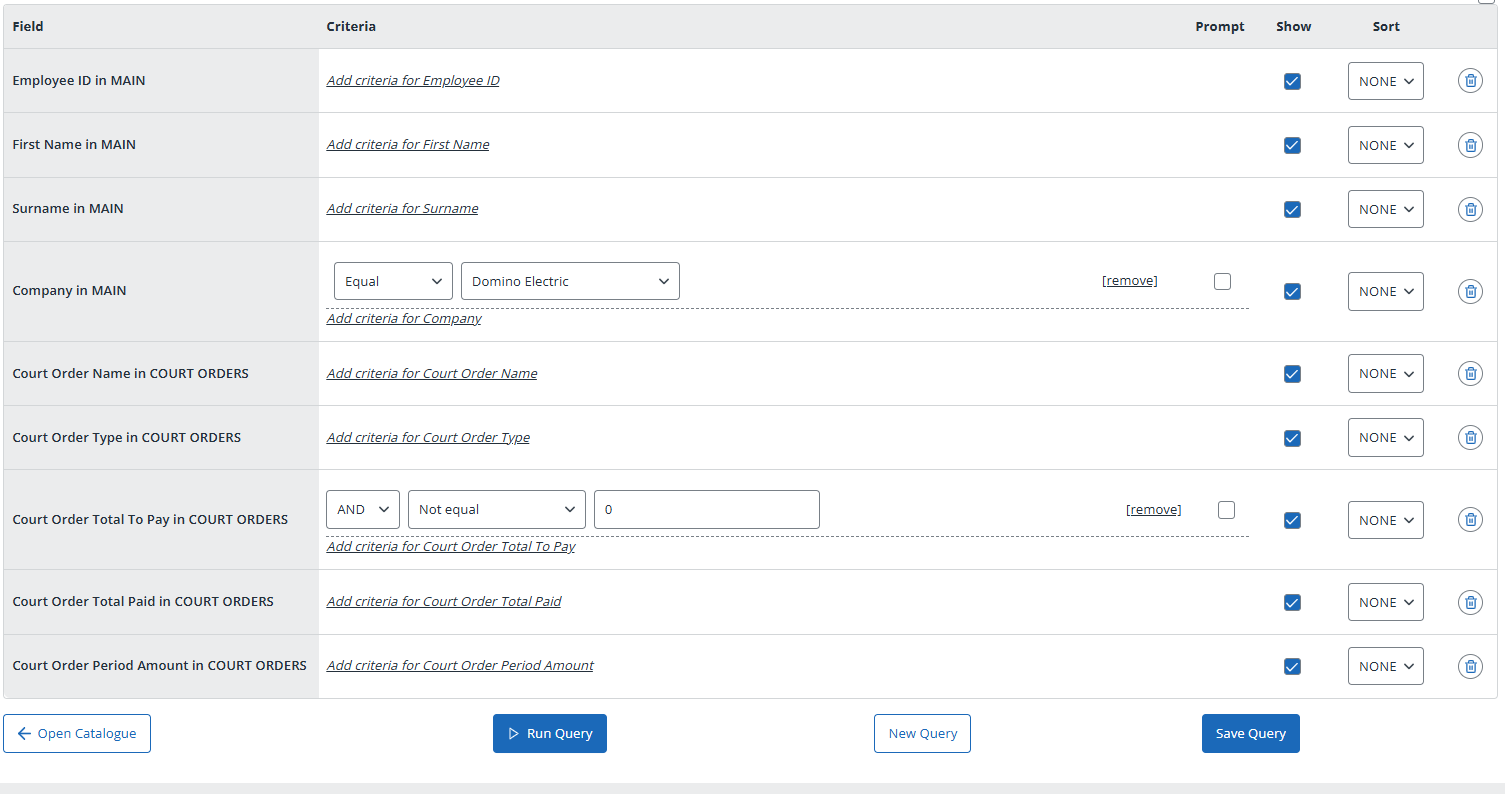

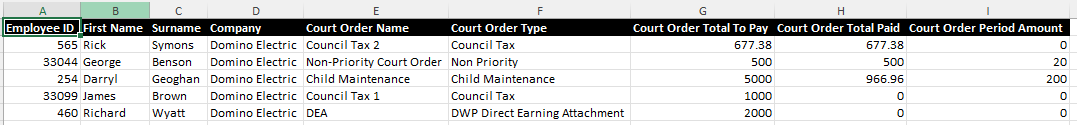

Static Data example query 2: Court Orders

The query shown in the screenshot below returns results for any employee who has a court order that is being processed through Payroll.

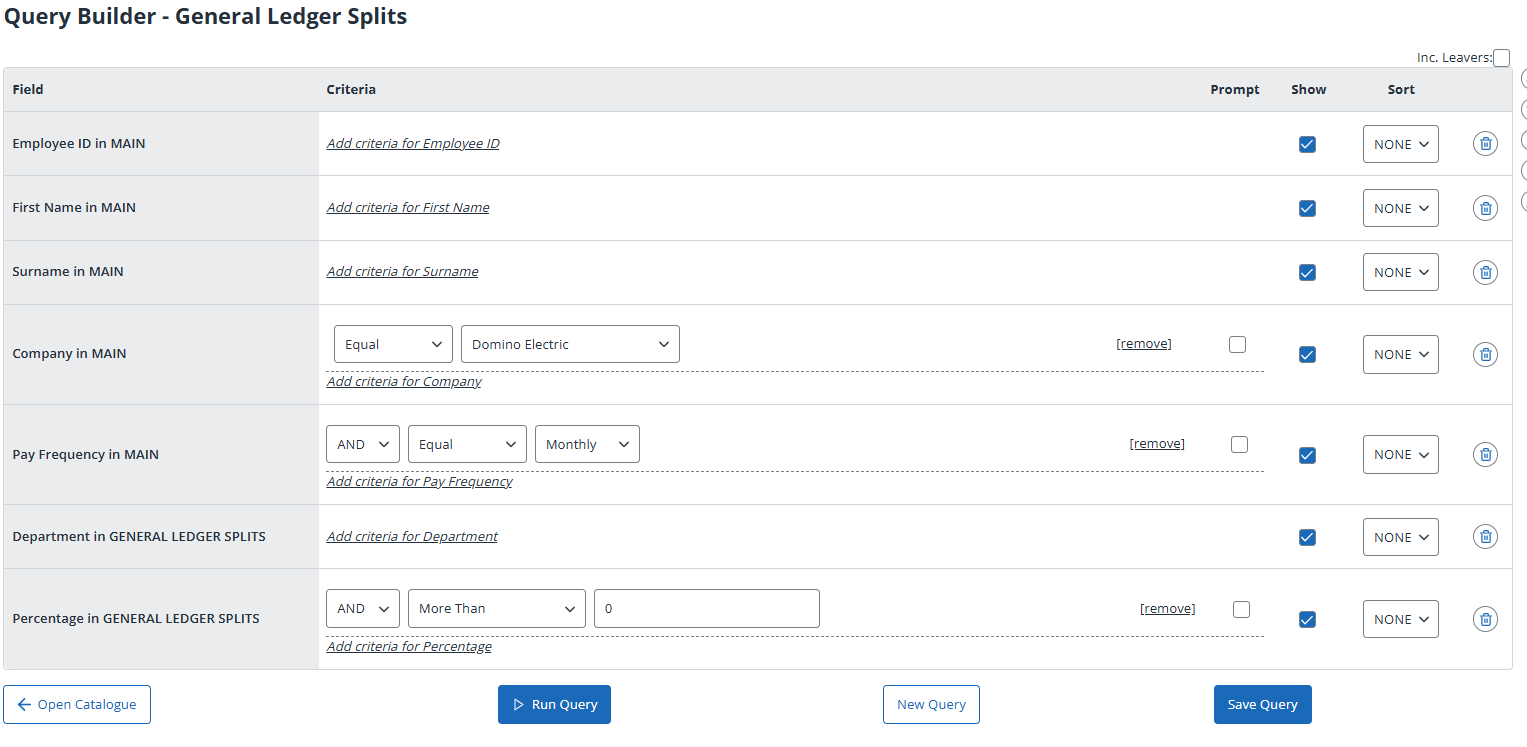

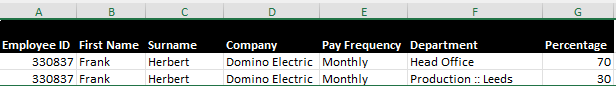

Static Data example query 3: General Ledger Splits

Static Data example query 3: General Ledger Splits

The query shown in the screenshot below shows you which employees’ costs are split across multiple departments, and the corresponding percentages.

Static Data example query 4: Pensions

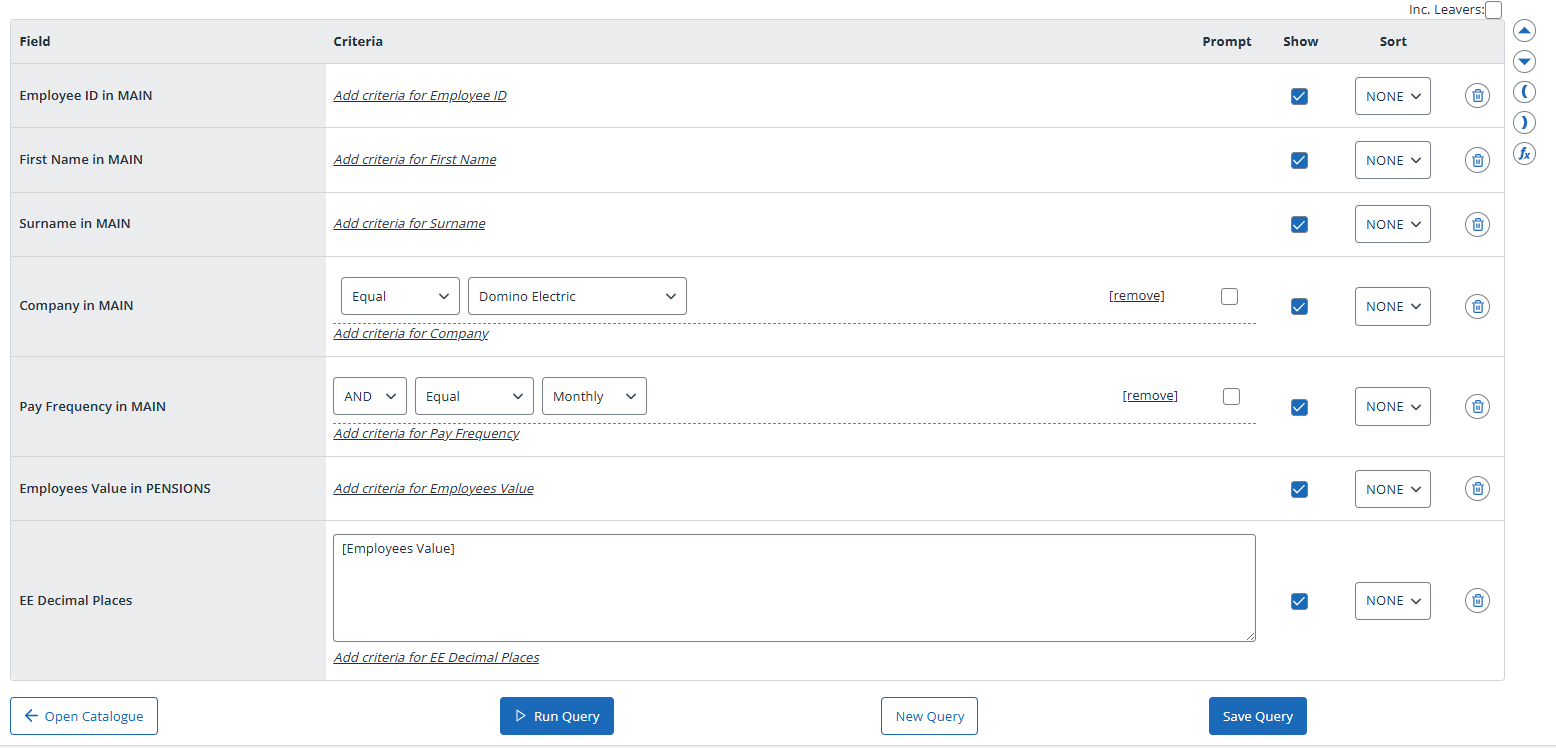

Some pensions are calculated to more than two decimal places, but Payroll Query Builder shows the percentage amounts to two decimal places by default. You can use the following steps to add a formula function to bring more than two decimal places into the query.

-

At the bottom of the screen, click New Query

-

At the left-hand side of the screen, select Pensions from the drop-down menu

-

Add the Employees Value field to the query

-

At the right-hand side of the screen, click fx to add a formula field to the query

-

In the formula box:

-

Select Reference a field from the query from the dropdown menu in the I want to field.

-

Change the field name from Formula 1 to, for example, EE Decimal Places.

-

Add the description [Employees Value], which is part of the description of the Employees Value in Pensions field. Adding this field ensures that the system:

-

-

Extracts the correct date

-

Looks at the Employees Value in Pensions field and returns the full value, which may be to more than two decimal places

-