Moving VAT Transactions to Another VAT Period/Quarter

You may need to move VAT transactions to a different VAT period/quarter if a future VAT period/quarter has been opened in error.

This topic provides an overview of how to move VAT transactions from one VAT period/quarter to another.

- Go to Maintenance, then select Accounts from the menu.

- The Accounts Maintenance dialog is displayed. Double-select to select the applicable VAT ledger.

- The Accounts Maintenance - VAT window is displayed. Select the applicable VAT period, which contains the transaction, from the left-hand panel. Select LINKS, then select Details.

-

The Detail Enquiry window is displayed. Select the applicable transaction, then select EDIT.

If the applicable transaction is allocated to a VAT return, you are not able to edit it. You need to copy and reverse the document into an open VAT period/quarter, then recreate the original document.

-

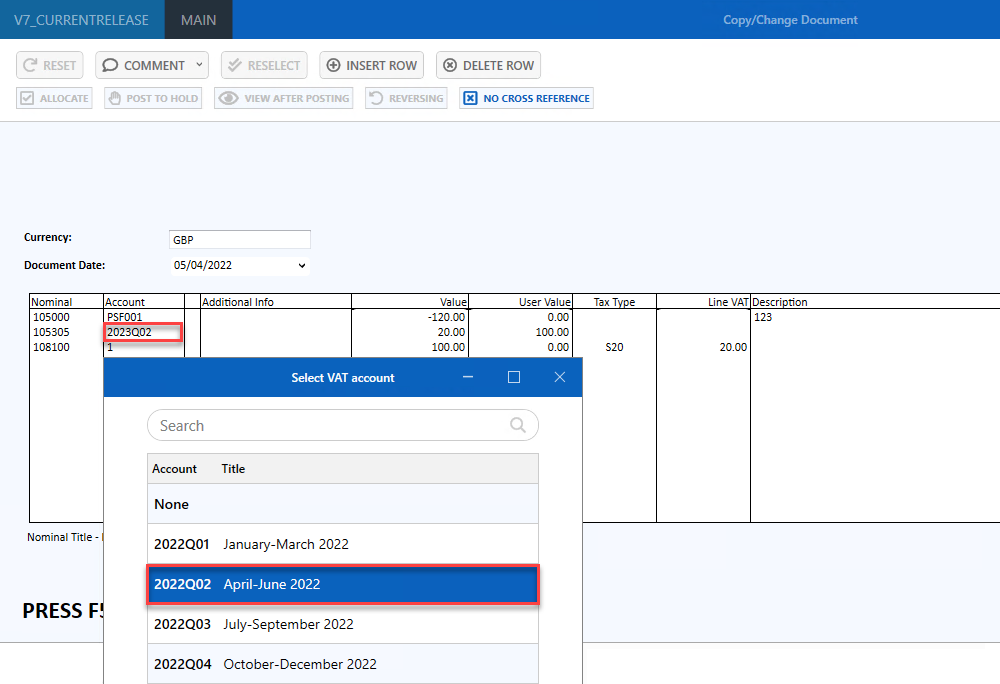

The PSFJournal document input form displays. Double-select in Account on the VAT line, then double-select to select the VAT period you want to move the document to from the Select VAT account dialog.

- Press F5 to post the document with the new VAT period/quarter.