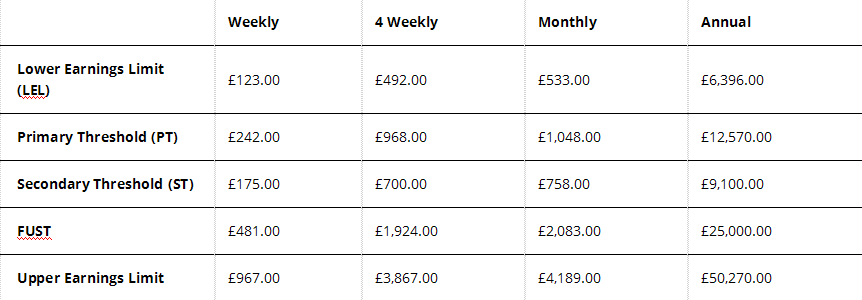

Update NI Parameters for July 2022

In the Spring Statement on 23rd March 2022, the UK government announced that from 6th July:-

The Primary Threshold for National Insurance will be aligned to the tax-free allowance from 6th July 2022 at £12,570.

-

Employment Allowance will increase to £5,000 for eligible employers and charities from 6th April 2022 - a potential annual NI discount of an extra £1,000 for those employers.

-

It is important these new rates are applied to all payments due to be made on or after 6th July 2022.

NI Thresholds from 6th July 2022 – 5th April 2023:

Importing the New NI Parameters File

Please find attached a new legislative parameter import file which contains the changes to the NI Thresholds effective from the 6th July 2022.

Do not import the parameter import file before you have finalised and completed the period end for all payrolls for payments before the 6th July 2022.

Import the updated NI legislation parameters processing any payrolls for all payments due on or after the 6th July 2022.

-

Right-click on the following link and select Save Link As, then choose a folder to save the file:

-

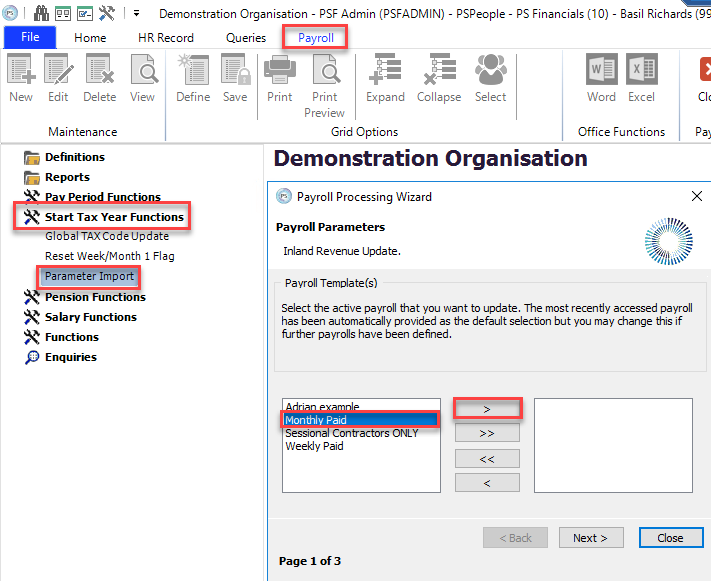

Log in to PS People and go to Payroll > Start Tax Year Functions > Parameter Import.

-

The Payroll Processing Wizard dialog displays. To update all payroll templates, select >> to move them all to the right-hand panel, then select Next.

Alternatively, if you only want to update one payroll category at a time, select >, then select Next.

-

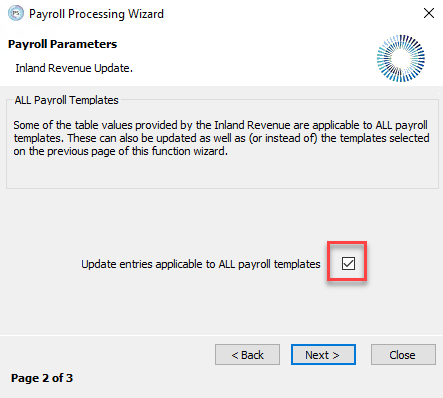

If you are updating all payroll templates at the same time, select the Update entries applicable to ALL payroll templates, then select Next.

If you only selected a single payroll template on the previous screen, do not select the box.

-

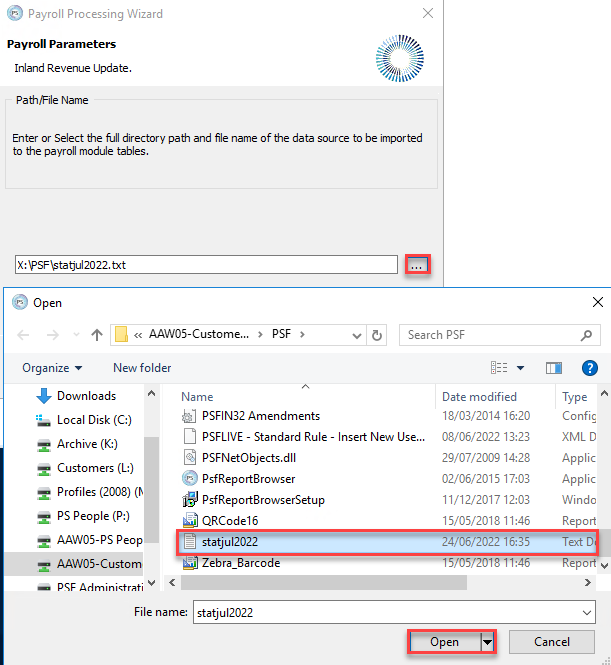

Select ... then select the legislation file you downloaded, then select Open.

-

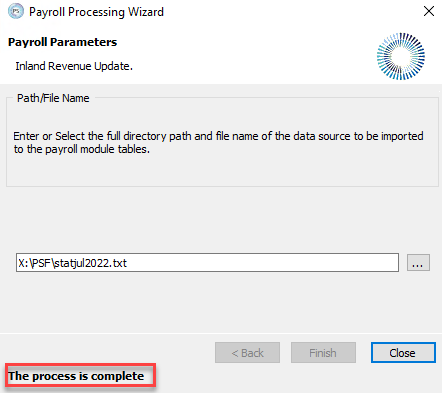

Select Finish. The Option Selection dialog displays. Select Yes to start the import.

-

When the update is finished, The process is complete message displays.