Posting an Accrual

An accrual is an amount due, or the calculation of an amount due, in an accounting period which is unpaid at the end of that period. This could be an insurance premium or an electricity bill not yet paid.

In the financial statements, accrued expenses are:

-

Added to the expense account (eg insurance account, electricity account)

-

Shown in the trial balance, before it is listed in the statement of profit or loss

-

Shown as a liability in the year end statement of financial position.

The reason for dealing with accruals in this way is to ensure that the statement of profit or loss records the expense that has been incurred for the year, instead of simply the amount that has been paid. In other words, the expense is adjusted to relate to the time period covered by the statement of profit or loss. The year end statement of financial position shows a liability for the amount that is due, but unpaid.

The automatic accrual reversals is a function performed on an Accrual Document Input and is used to automatically reverse and allocate any accrual posted in the system at the Date, Year code and Period specified on the original posting.

-

From the IRIS Financials main menu, go to Options > Document Input and select the applicable AC document type. For example ELAC.

-

Select applicable Accruals document from the Input Form drop-down list.

-

Select the Document Date as the date the accrual is being posted.

-

Select the Document Period as the period the accrual document is being posted and select OK.

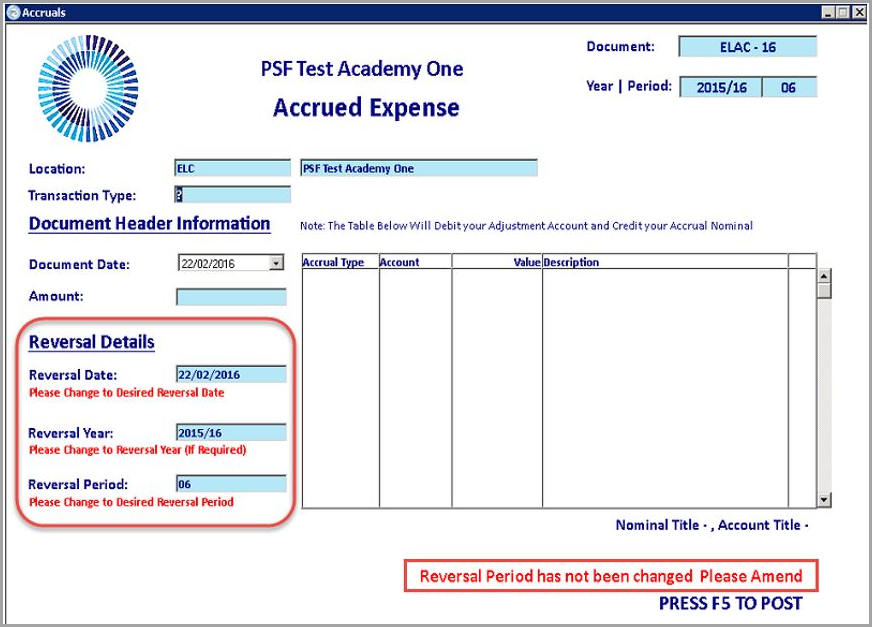

The Accrued Expense document displays. Complete the mandatory fields:

Reversal Date - Date the accrual reversal will be posted with.

Reversal Year - Year the accrual will be reversed into.

Reversal Period - Period the accrual will reverse into.

-

Double-click in the Accrual Type field and select an applicable accrual type from the list. If an applicable accrual profile is not showing, you can create a new one. Refer to Creating a New Accrual Profile.

-

Double-click in the Account field and select an applicable account to accrue against.

-

Enter a Description to identify the document after it has been posted then press F5 to post.

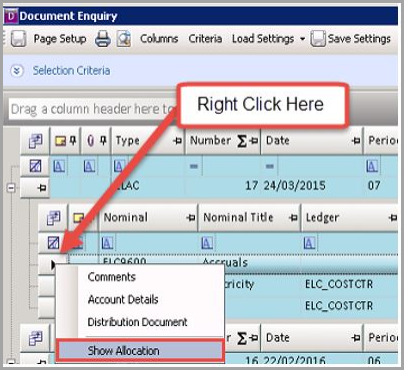

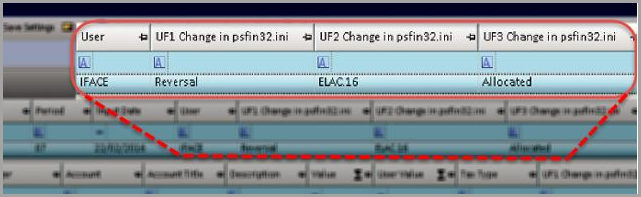

When viewed in an account enquiry, the document header row will show that it is a reversal document in UF1. The source document (the original accrual that created the reversal) in UF2 and that is it allocated in UF3.

The document will now be allocated to the source accrual on each detail line and will be allocated at a nominal Level or an account Level depending on whether the accrual has been posted against a nominal with or without a ledger you can see this by right clicking on a detail line and selecting Show Allocation.