Producing a Bank Reconciliation Report

The Bank Reconciliation Report in the reporting suite shows the unreconciled items as at a particular date.

- Go to Modules, then select Reporting Suite.

- Select Bank Reconciliation Report from Additional Reports.

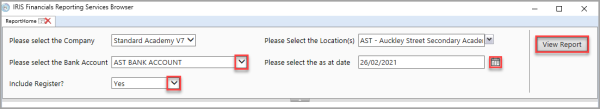

- The company and location for the report are automatically selected. Select the required bank account from the Please select the Bank Account drop-down list.

- The as at date defaults to today's date. If you want to change the as at date, select the calendar icon adjacent to Please select the as at date.

- If you want to include documents posted in the register period, select an option from Include Register?.

- When you have selected the criteria for the report, select View Report.

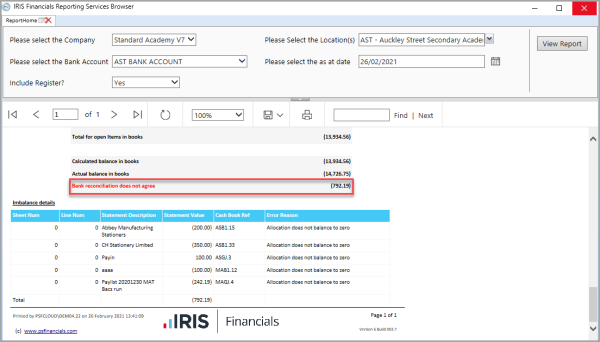

- The Bank Reconciliation Report is displayed. To print of save a copy of the report, select either the Print icon, or select the Save icon and select an option from the drop-down menu. The report consists of the following sections:

- Open Items in Bank - displays unreconciled items showing in the bank statement as at the date specified.

- Open Items in Books - displays unreconciled documents posted to the bank nominal (cash book).

- The Summary contains the following detail lines:

- Actual Balance at bank - displays the balance of the statement.

- Total for open items in bank - displays the total of unreconciled statement items.

- Total for open items in books - displays the total of unreconciled cash book items.

- Calculated balance in books - displays the total statement balance plus or minus value of open bank reconciliation items above.

- Actual balance in books - displays the balance of Bank nominal code.

If the Bank Reconciliation does not agree line in the Summary shows a difference it is due to the dates of some of the reconciled items. For help resolving the issues, go to Bank Reconciliation does not agree Message.

Bank Reconciliation does not agree Message

If the Bank reconciliation does not agree line of the Summary is displayed in red, showing a difference, such as (792.19), the most common reason is that the dates on the items that have been reconciled.

A breakdown of the items causing the imbalance are displayed in Imbalance details. You can use these details, with the following steps to balance the Bank Reconciliation Report.

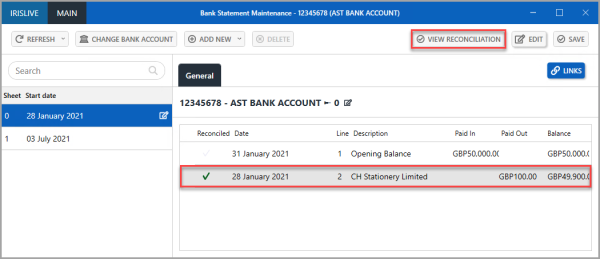

- Go to Banks, select Bank Statements, then Select a bank account.

- Select the Bank Statement that contains the imbalanced item from the left-hand panel. If the items have been reconciled, a green Tick icon is displayed in the Reconciled column.

- Select the reconciled transaction, then select VIEW RECONCILIATION.

- The View Reconciliation window is displayed. If the date on the document displayed in the right-hand panel is later than the as at date on the Bank Reconciliation Report, then the original document needs to be unreconciled and amended. For more information, go to Unreconciling Transactions and Editing Existing Documents.