Overview of Budgeting Using

Some Of the nominals and ledgers used in this topic may be different to those in your chart of accounts.

Budgets are used to record estimations of income and expense based on future plans and objectives. Reports can be subsequently produced to compare the budget against actual performance, in order to establish variances and take remedial action.

An establishment / organisation must monitor and manage their own budgets to ensure effective financial oversight of public funds. In Education, the ESFA (Education and Skills Funding Agency) reviews budget projections and actual results to assess financial health and to ensure the estimates of the future funding requirements are accurate.

There are huge variations in the budget requirements of each location that it is not possible for us to provide specific budgetary advice however, the following can be considered for education:

-

Review budgets from previous years and compare which figures were estimated accurately and which costs went over budget. This helps to ensure the budget is as accurate as possible.

-

Check the pupil numbers of other locations as this could impact your establishment / organisation numbers.

-

Have staff costs to hand from previous periods. These enable you to see where forecasts were adhered to and where more budget may need to be allocated. For example, within certain departments or supply teacher fees.

-

Reviewing exam results can help to ensure each department is getting the budget allocation they need - some may need more attention/investment than others.

-

Consider additional costs, such as insurance and maintenance.

Where do I Enter my Budget Data

Mostestablishment / organisation's create a draft budget using a spreadsheet, which is circulated to interested parties until agreed. The way that the income/expenditure is allocated in the spreadsheet then needs to be recorded in IRIS Financials.

The Chart of Accounts is a complete list of financial codes (nominals) that provide a way of categorising income and expenses into logical groups, similar to the principle of labelling. When an establishment / organisation spends or receives money, it needs to be classified, such as money spend on stationery, income from trips, or bank interest, etc. The nominal identifies what is being spent or received.

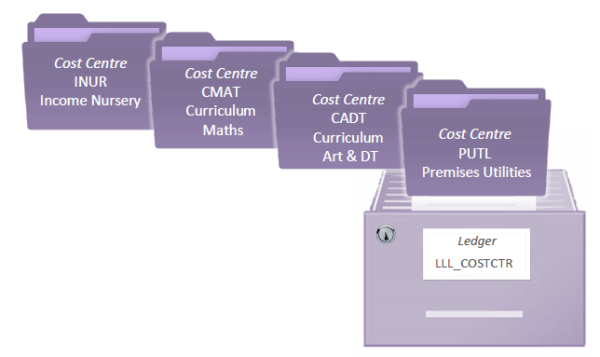

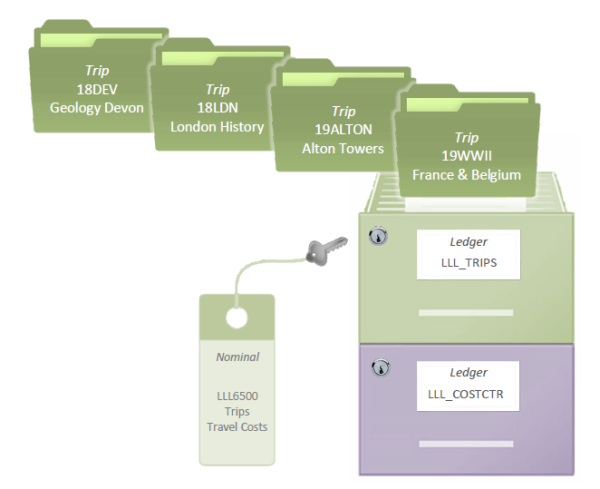

A ledger is used to store a set of related unique records, referred to as ledger accounts. Each ledger has one or more ledger accounts. For example, the LLL_COSTCTR ledger (where LLL represents the establishment/organisation location code) might have cost centre accounts for each department in the location. The ledger can be likened to a drawer in a filing cabinet, where each ledger account is a file within the LLL_COSTCTR drawer.

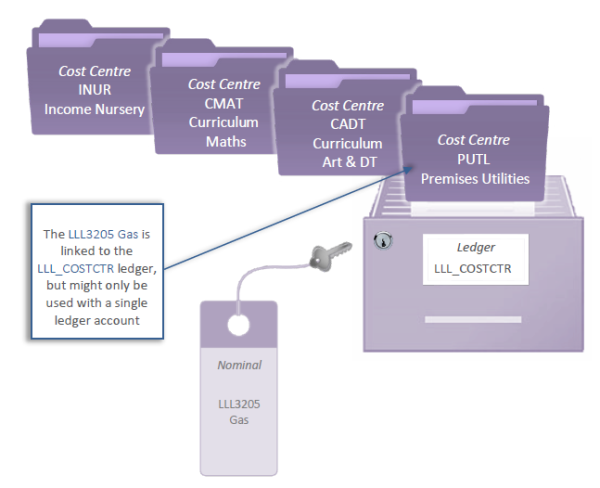

Most nominals are linked to a ledger (they can only be linked to one ledger). Linking nominals to a ledger determines what accounts are available for selection when recording transactions. This can be likened to the nominal having a key to the ledger filing cabinet drawer. While the nominal can be linked to only one ledger (i.e. have a key for only one filing cabinet drawer), a ledger can have multiple nominals linked to it (i.e. there can be many keys that open the same filing cabinet drawer).

For example, the LLL3205 Gas nominal is linked to the LLL_COSTCTR ledger. All cost centre account within this ledger are available for selection because of this link, as shown in the following graphic. Effectively, the LLL3205 nominal has the key to the LLL_COSTCTR filing cabinet drawer and all the folders within it.

When entering budget data, you select the nominal first (to determine what is being spent/received), then select the applicable ledger account to which the budget is to be added (to determine where the cost or income is allocated). The ledger accounts available for selection are based on the ledger to which the nominal is linked.

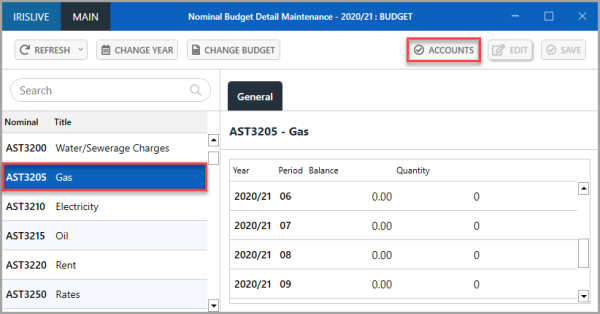

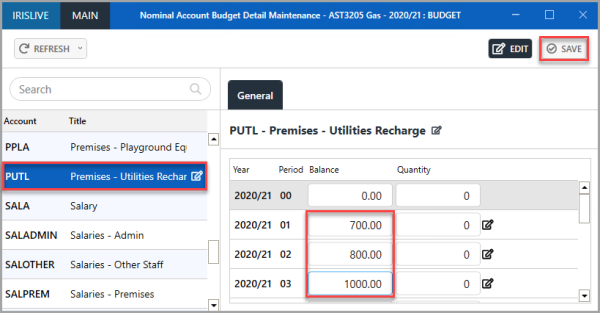

This information is entered by selection the required nominal from the Nominal Budget Detail Maintenance window, then selecting ACCOUNTS, (accessed by selecting Maintenance > Nominal Budget Details from the menu).

The Nominal Account Budget Detail Maintenance window is displayed with the accounts available from the ledger to which the nominal is linked in the left-hand panel. The required budget values can be entered for each required period.

Based on the previous graphic, a total of £2500 is being budgeted for the PUTL - Premises - Utilities Recharge ledger account, which is to be spent on Gas (the 3205 nominal). If required, the cost can be split across multiple ledger accounts, i.e. multiple cost centres.

The nominal LLL650 - Trips Travel Costs is linked to the LLL_TRIPS ledger. The individual trip accounts are available for selection because of this link, such as 19WWII France & Belgium. A budget value can be recorded for each trip.

Choosing Whether to Manually Enter or Import Budget Data

When creating budgets in IRIS Financials, values need to be entered for all required nominals, ledger accounts, and financial periods. This defines what the budget is being spent on (or what the budget is being received for), where the cost/income is being assigned and when the cost/income is predicted to be spent/received.

There are two ways that this can be achieved – manual entry or importing.

Manually Entering data

Data can be manually entered into IRIS Financials. This is achieved by selecting a nominal, then the required ledger account, then entering a budget value for each period.

This can be more time consuming than importing, but enables each nominal, account, and budget value to be meticulously entered as you proceed and as a consequence, reduces the risk of errors.

The process needs to be repeated from scratch each year because you are unable re-use the budget from the previous year.

Importing Data

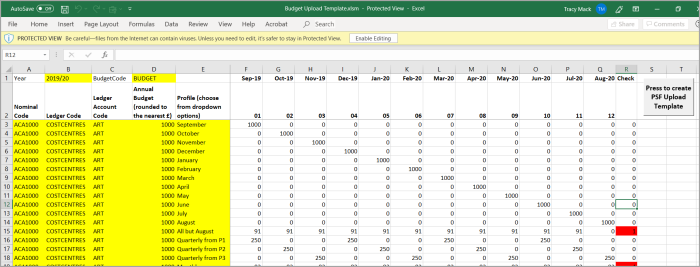

A budget can be entered into IRIS Financials by completing a spreadsheet template (called the Budget Upload Template) which can then be imported. The spreadsheet provides the facility to enter the nominal, ledger code, and ledger account, together with the annual budget for each nominal/ledger combination.

By choosing a profile in the spreadsheet, you can determine how the annual budget should be apportioned (monthly, quarterly, etc.) This can save a significant amount of time by not having to manually enter (and calculate) values for each period.

Importing is our recommended option for the following reasons:

-

Draft budgets are often worked on internally using spreadsheets. Once agreed, this data can then be easily copied into the Budget Import Template spreadsheet.

-

The completed Budget Import Template spreadsheet can be easily reviewed by others prior to importing into the system.

-

Importing is much faster than manual entry.

-

Any required amendments can be made by applying the changes to the import spreadsheet, then re-importing.

-

The Budget Import Template can be re-used year-on-year – simply review and edit the values in the spreadsheet and import for the new financial year.

-

An existing budget code can be chosen, preventing the need to change the default budget used in IRIS Purchasing at the start of each year.

Using Budget Codes

Each budget in IRIS Financials has a unique code used to identify and select the budget throughout the system. The same budget code can be re-used year on year because the system uses a combination of the budget code and the applicable financial year. It is therefore possible to use the BUDGET code for both the 2018/19 and 2019/20 financial years.

New budget codes can be created if preferred, but in doing so, the default budget used in IRIS Purchasing needs to be changed each year.

If you do have a long list of budget codes, existing codes can be hidden to avoid confusion. For more information, please see Hiding a Budget.

Financial Years and Periods

Before manually adding or importing a budget, make sure that the required financial year/accounting periods have been set up. Any import fails if the correct year/periods do not exist. For more information, please see Manually Adding Accounting Periods.