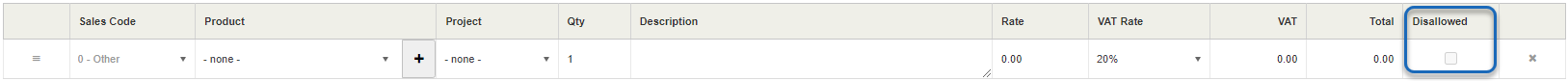

Disallowed option

The Disallowed checkbox will now display as an option on sales, purchases, mileage and bank transactions.

By selecting this option you are telling IRIS KashFlow that this amount represents an expense or partial expense that cannot be claimed for tax purposes. Selecting this option will ensure the values feed the SA103 report correctly, where required.

Previously, disallowed amounts had to be manually entered on the SA103 report. In line with HMRC guidelines for MTD for ITSA this needs to be based on transaction data and manual entry will no longer be allowed.

You will only be able to select Disallowed if the nominal used is of 'expenditure /cost of sale' type and associated with a valid SA103 category; otherwise it will be unchecked and disabled.

If you are not using this report or not aiming to use this report in near future, you don't need to worry about this new attribute at this stage and can ignore it. Otherwise, if you are a sole trader trader, you might want to start making use of it in preparation for MTD for ITSA.

Read more on Making Tax Digital (MTD):

Making Tax Digital (MTD) for Income Tax Self Assessment (ITSA) allows you to digitally send your ITSA returns from IRIS KashFlow to HMRC. From April 2024, it will be mandatory for all for self-employed businesses and landlords with an annual income above the £10,000.

Currently, we have implemented MTD ITSA for self-employed businesses only. Click here to register your interest if you are a sole trader wanting to participating in the pilot scheme.