Manage your chart of accounts

A chart of accounts is full list of all the financial codes (or nominal codes) used in your business. Each transaction recorded is posted to a nominal code. This allows you to break down the transactions made during a specific period, into various categories and sub categories.

The settings here impact how your reports are calculated such as your Profit & Loss, Balance Sheet and Trial Balance. Your chart of accounts shouldn’t be modified without the advice of your accountant.

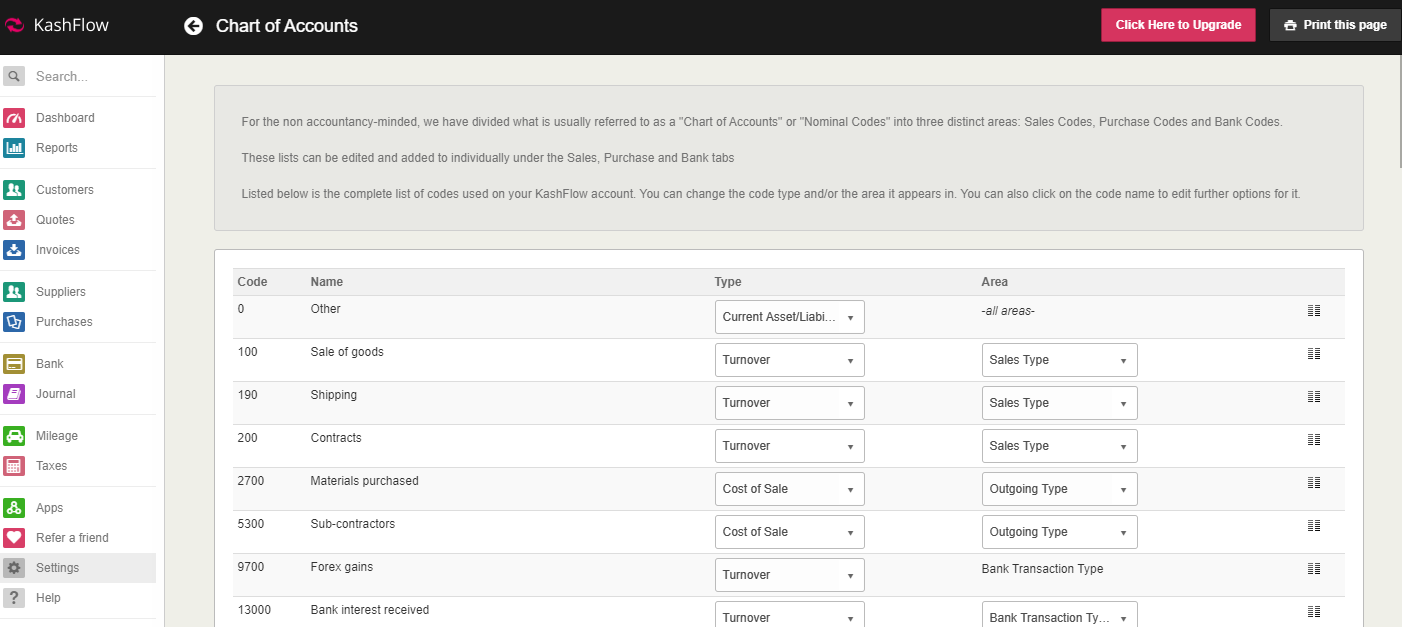

Add or edit your chart of accounts

-

Go to Settings. (If you've switched to the new design, select your initials, then Account Settings.)

-

From the List section, select Chart of Accounts.

-

For existing codes, select the required Type or Area for the list.

-

To add a new code, enter the Code, Name, select the Type and Area, then select Add New Code.

Nominal code types

Profit and loss code types

Determines where the balance of the account will appear on your profit and loss report and balance sheet. There are 6 types split into 2 categories - Profit and Lossand Balance Sheet.

-

Turnover - income received by a business and treated as revenue. This is usually used for sales.

-

Cost of Sale - the money spent (overheads) on generating revenue such as the wholesale price of product that you resell.

-

Expenditure - operational or administrative expenditure.

Balance Sheet code types

-

Fixed Asset - an asset that cannot be easily converted into cash such as property, vehicles, cash registers, etc.

-

Current Asset / Liability - the account should be treated as a current and variable asset when the balance is a positive, and as a debt (known as a liability) when the balance is negative. This is normally used for bank accounts. When your bank balance is positive it’s an asset, when you’re overdrawn you’re in debt and it’s a liability.

-

Capital & Reserves - capital is the money shareholders have contributed to the company. Reserves are the profits earned and other resources received by the company that have been kept for the benefit of shareholders.

Nominal code areas

Nominal code areas determine where the nominal code will appear when inputting data.

They are split into 3 types.

- Sales Type -the code can only be used in the sales area for sales invoices.

- Outgoing Type - the code can only be used in the purchases area for purchase invoices.

- Bank Transaction Type - the code can only be used in the bank area for bank transactions.

Advanced configuration options

Select Show advanced configuration options to edit the advanced options.

Choose from the following:

Allow me to access all codes in all areas - shows all your nominal codes in all areas of IRIS Elements Cashbook. It is unlikely that you'd want to select this option without guidance from accountant because using an incorrect nominal code in the wrong area will affect your reports.

Allow me to configure Fixed Assets, Cost of Sale (etc) options directly on the page where I edit nominal codes instead of just from this page - allows you to set the nominal codes type from within the nominal settings rather than only on the Chart of Accounts page. To avoid accidentally setting a nominal code incorrectly, this option should not be selected.

Enable the journal - selecting this option enables the journal area of IRIS Elements Cashbook. The journal area allows you to transfer an amount or balance from one nominal account to another. This area should only be used with the advice of your accountant.

Show numeric codes in drop-down lists, not just the code names - selecting this option shows both the nominal code number and name in lists.

When you’ve made your changes, select Update.