Record deposits / advanced payments to suppliers

Some suppliers may ask for a deposit or some form of advanced payment. This needs to be recorded so that you can allocate the advanced payment to the applicable purchase.

-

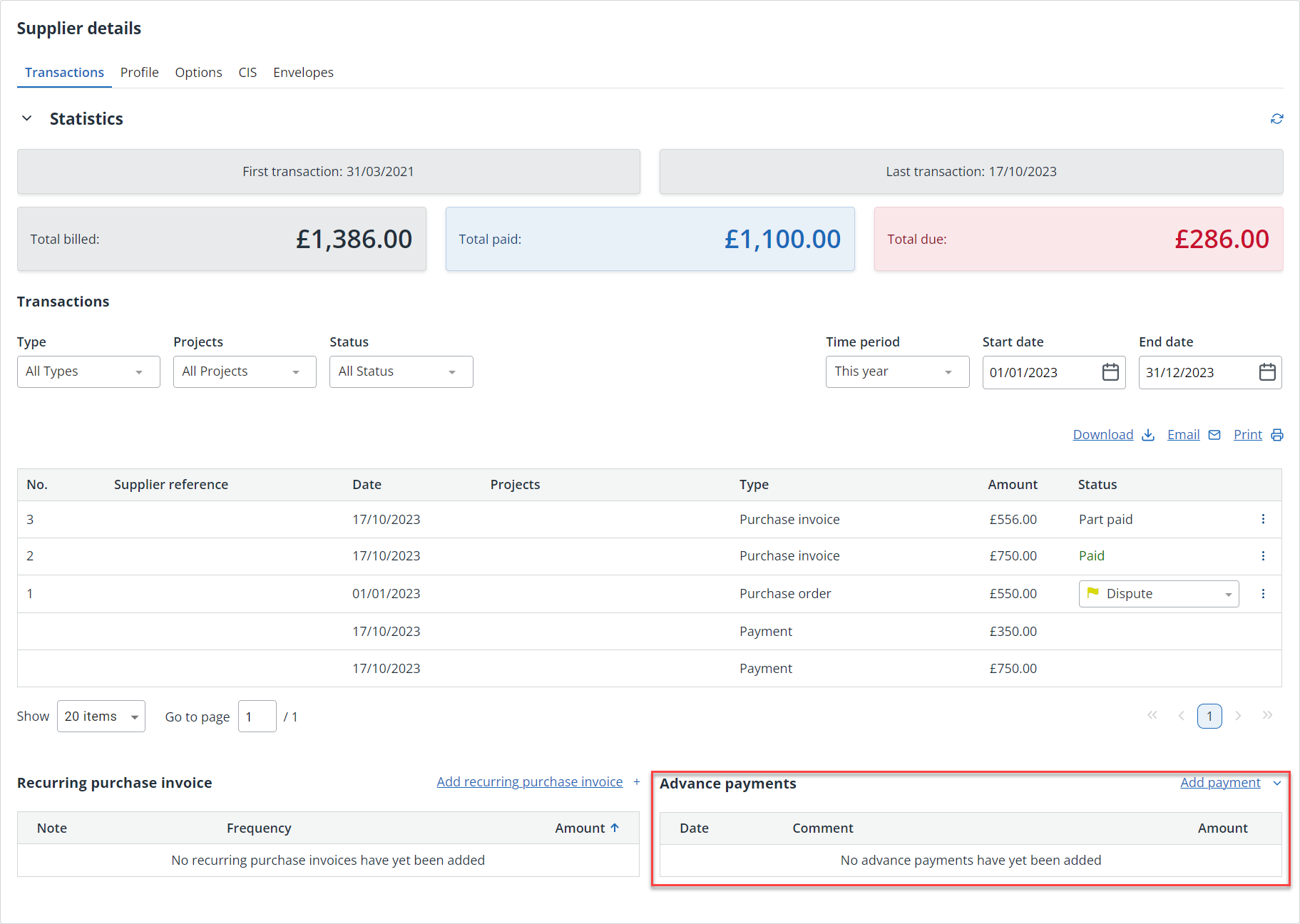

Go to Purchases > Suppliers, then select the supplier.

-

Select the Transactions tab.

-

From the Advanced Payments section, select Add Payment, then choose the account the payment is coming from.

-

From Add Transaction, select the Date the money left your account.

- The Code defaults to the creditors control and should not be changed. The supplier is also automatically selected.

- Amend the default Comment of Supplier overpayment if required.

- Enter the amount you have paid the supplier in the Out box.

- If you are VAT registered, the VAT Rate defaults to N/A as advanced payments are not VATable and should not appear on your VAT return.

-

Select Add Transaction.

Apply an advance payment to a purchase receipt

- Go to Purchases > Purchase invoices. Select the appropriate invoice from the list.

-

From the Payments section, select Apply Credit.

-

Select the credit to use from the list then select Apply.

If the advanced payment is more than the purchase receipt amount, the receipt will be marked as overpaid. You can continue to apply this credit in the same way until there is no outstanding credit. Any outstanding amount is shown at the top of the receipt and when you select Add Payment.

If the advanced payment is less than the purchase receipt amount, the payment details section will show a line with details of the payment. The date, amount and comment will match what was originally recorded when the advanced payment was added.