Within Tax Platform select an Individual client.

From the Client Tax Returns tab select a 2012/2013 Tax Return and select View Tax Return.

Select Add New Tax Return if a 2012/2013 return has not yet been created.

Click the Self Employment supplementary pages via the fanned pages icon on page TR2.

Click Add for a new Self-employment (Full).

The Capital Allowances facility is not available on the Short form.

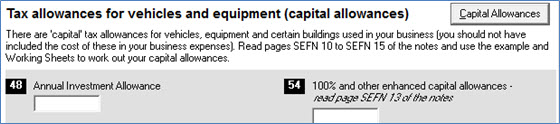

The new option for Capital Allowances is located in the Tax allowances for vehicles and equipment (capital allowances) section of the return.

Click Capital Allowances.

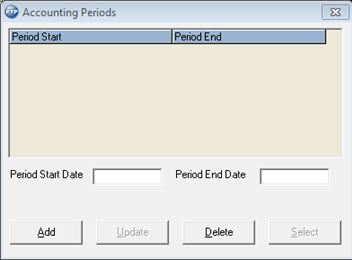

Click Add and enter the period dates and click Save.

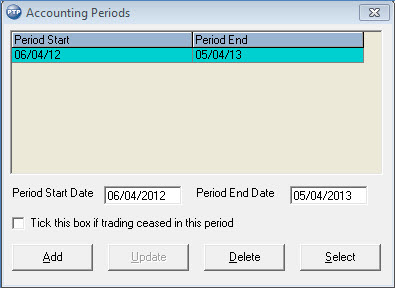

To enter data, highlight the relevant period and click Select.

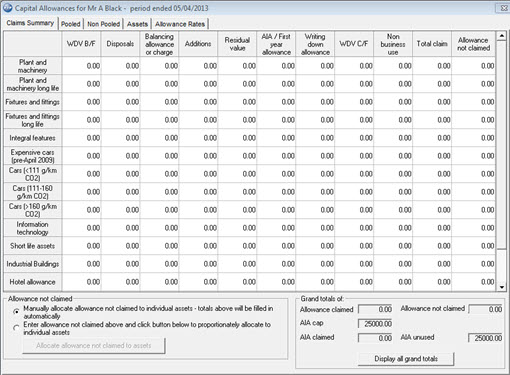

The following screen displays.

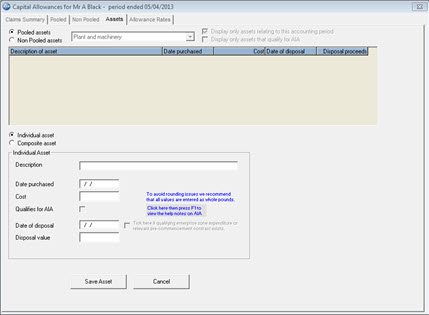

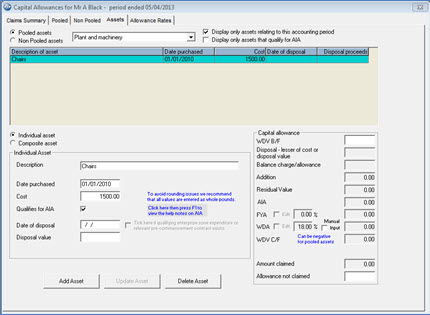

Select the Assets tab to enter data.

Select Pooled assets or Non Pooled assets from the radio buttons at the top.

Select a category from the drop-down list, for example, Plant & Machinery and then click Add Asset.

Enter the details and click Save Asset.

If the date purchased is prior to the beginning of the period then a WDV

B/Fcan be entered.

Once Capital Allowances has been selected and the user is presented with the Accounting Periods screen any period can be selected.

The period selected will determine the calculations made within the Capital Allowances screen when opened.

If the period selected matches the period entered on the return the Capital Allowances data will automatically be updated appropriately in the relevant boxes.

If the period doesn’t match either because no period has yet been entered on the return or an old period has been selected for review then a warning displays and no Capital Allowances data will be updated.

Within Tax Platform select a Partnership.

From the Client Tax Returns tab select a 2012/2013 Tax Return and select View Tax Return.

Select Add New Tax Return if a 2012/2013 return has not yet been created.

Click to Add/Amend/Delete Partner(s) if required then select Add Trade/Source to

Partnership (if a Trade already exists, select to View/Enter Details for Trade/Source).

Select to open trade pages under Q3 by clicking on the fanned pages icon.

Select to View the Trade or Profession (or select Add if required).

Go to page PT1.

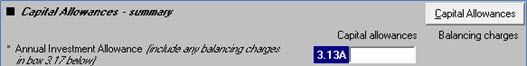

The new option for Capital Allowances is located under the Capital Allowances – summary of the return: