|

|

Partnerships which are added to the data base via the Personal Tax module do not take up a license slot.

Log on to IRIS Personal Tax and select the client.

Click Trade, Profession or Vocation then click Sole Trade or Partnership.

Click New within the top half of the screen on the right.

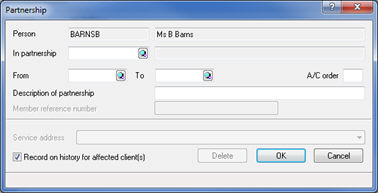

Click the Partnership tab within the client involvements screen then click New.

Click New within the client browser screen.

Enter the business details and give the business its own unique identifier.

Select the business from the client browser then enter the From date. This is the date that the client became a partner in the business then click OK.

The business name will display at the top half of the screen, the account period end date can be added as follows:

Click New within the bottom half of the screen.

Enter the required New year-end date.

Click OK.

If the trade commenced several years in the past, it is recommended that at least one previous period end date is entered as this will help IRIS to establish what the correct basis period should be.

To enter income and expenses, click on the Period end date then click OK.

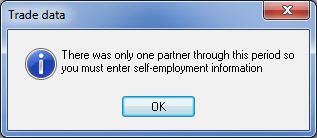

If you do not act for the business, only the individual partner

the following warning will be generated:

In this situation it will be necessary to nominate another client as a partner of this business so IRIS will recognize the status of the business as a Partnership. It is recommended that a client be created called Mr. Partner and that Mr. Partner be nominated as a partner of this business. Mr. Partner can also be used if any other client is in this situation in the future.