Basis Period Reform

Introduction

As part of the Basis Period Reform which takes effect from 06/04/2024,

Individual’s Sole trades and Partnerships will terminate the use of ‘Current Year Basis’ rules and will

commence using ‘Tax Year basis’

rules. This will likely impact businesses that do not have 31/3/ to 5/4

year end. In Preparation for this, a Transitional

Year will occur in tax year 2024.

Rules for Transitional Year in Tax Year 2024

General:

- Transitional profits apply to Businesses that do not have 31/3/to

5/4 year end.

- The Basis period will begin from the start of the standard accounting

period that falls within the year, and will end on the 5th April 2024.

- The basis period profits are split into Standard

Part (standard accounting period) and Transition

Part (next/future accounting period, which is apportioned up

until 5th April 2024).

- Once transition profits are realised (using calculation) the transition

profits are apportioned to 20% and each 20% is spread over the next

5 years. This is called spread of the transition profits, the user

can choose to pay more in the current year and the rest will be carried

forward and re-calculated in the next year.

Overlap Profit:

- All unused overlap profits will be lost at the end of the 2023-24

tax year.

- If Overlap relief creates a loss then the loss can be treated as

a terminal loss and be carried back. The user can use the ‘carried

back’ field for this.

Losses:

- All unused overlap profits will be lost at the end of the 2023-24

tax year.

- If Overlap relief creates a loss, then the loss can be treated

as a terminal loss and be carried back. The user can use the ‘carried

back’ field for this.

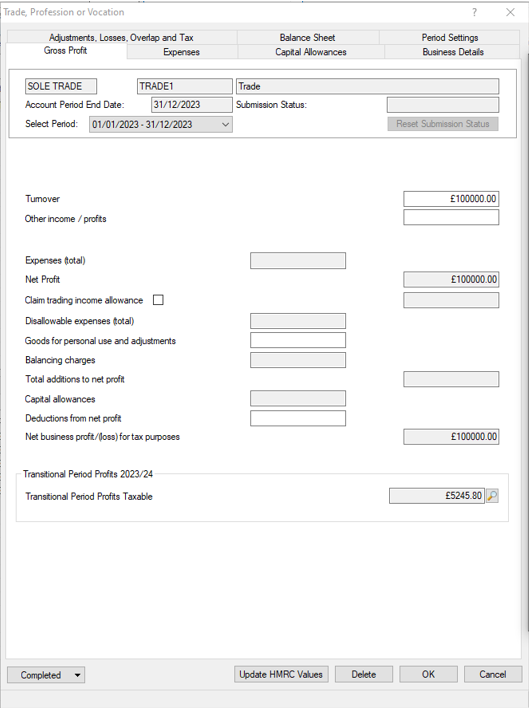

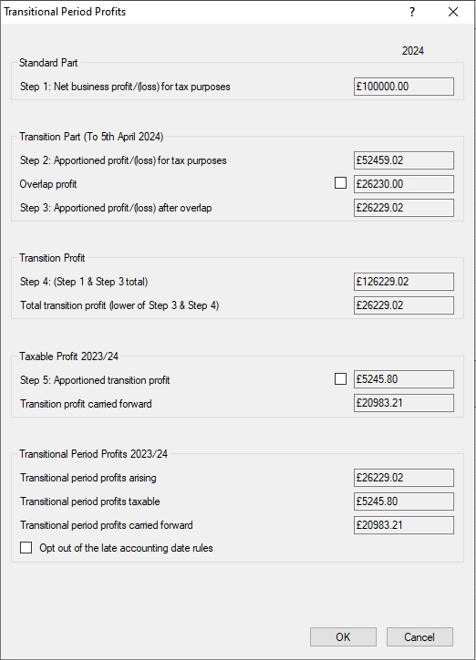

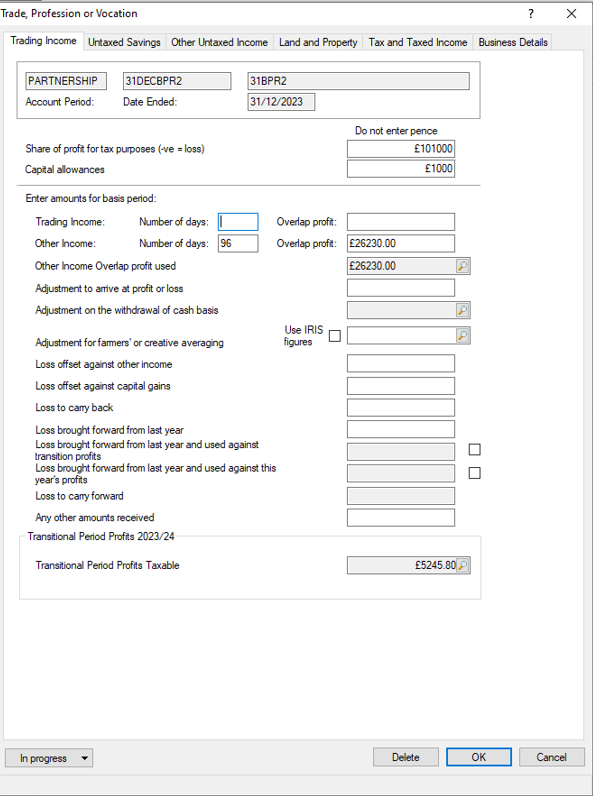

To view the Transitional Period Profits calculation:

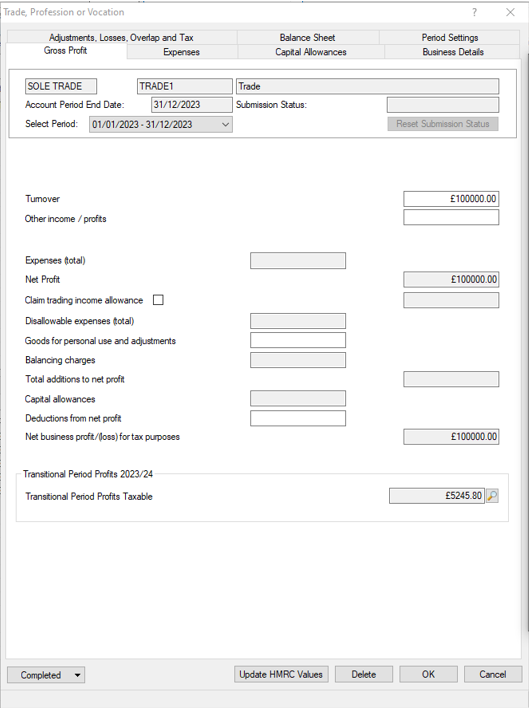

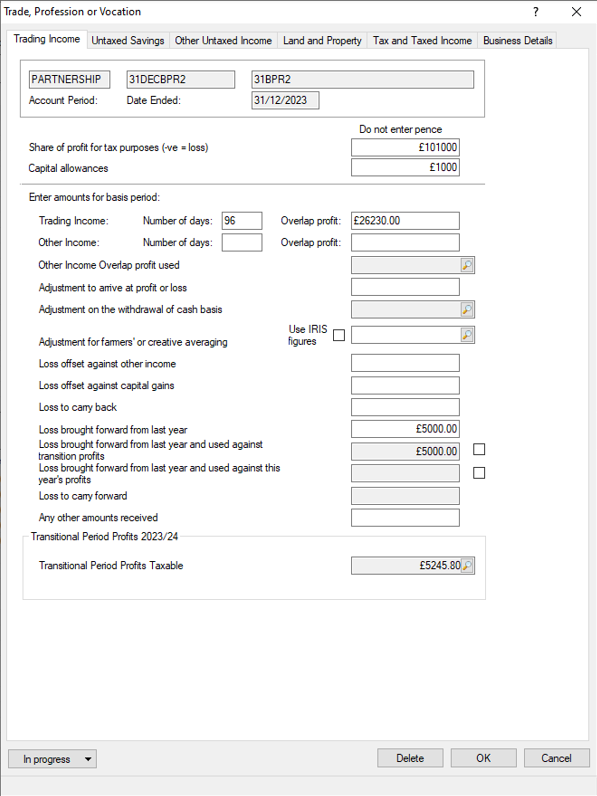

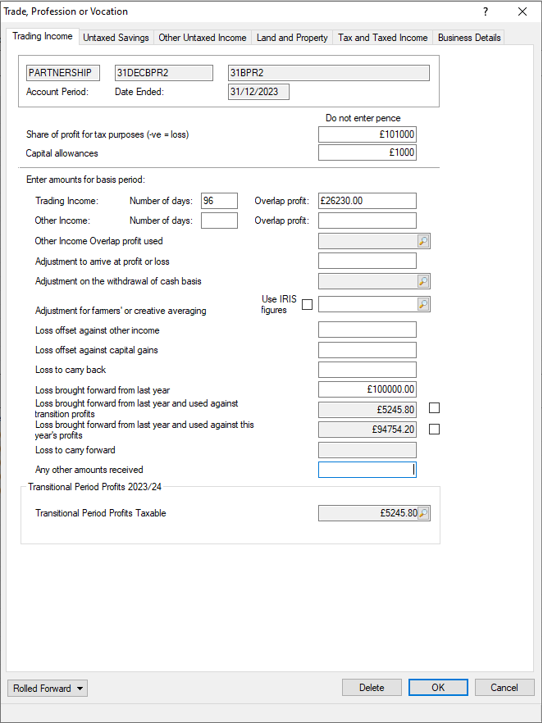

- Go to Income | Trade,

Profession or Vocation | Sole

trade or Partnership | open the accounting period which falls

within tax year 2024

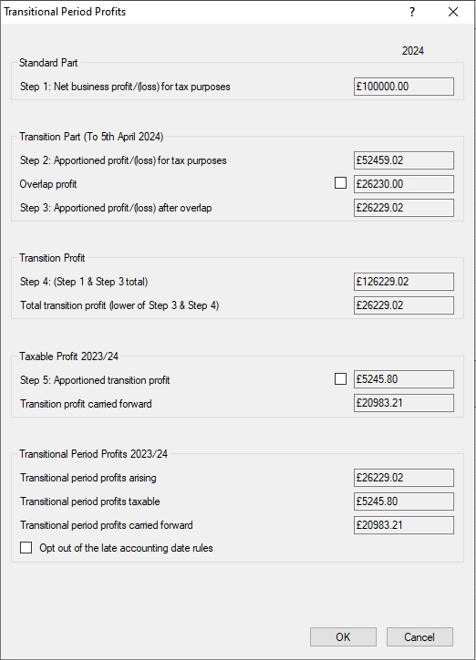

- Select the magnifying glass next to Transitional Period Profits

Taxable:

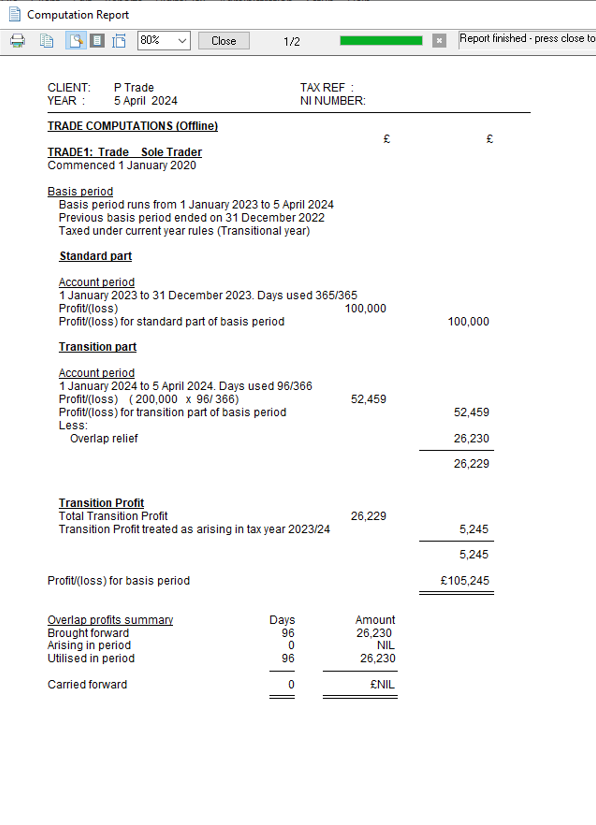

Standard Part

Step 1 - Net business profit/loss for tax purposes

- Sole trade - this is the

total Net business profit/loss for

tax purposes for the standard accounting period and maps to

box 64/65 on the Self-employment

pages.

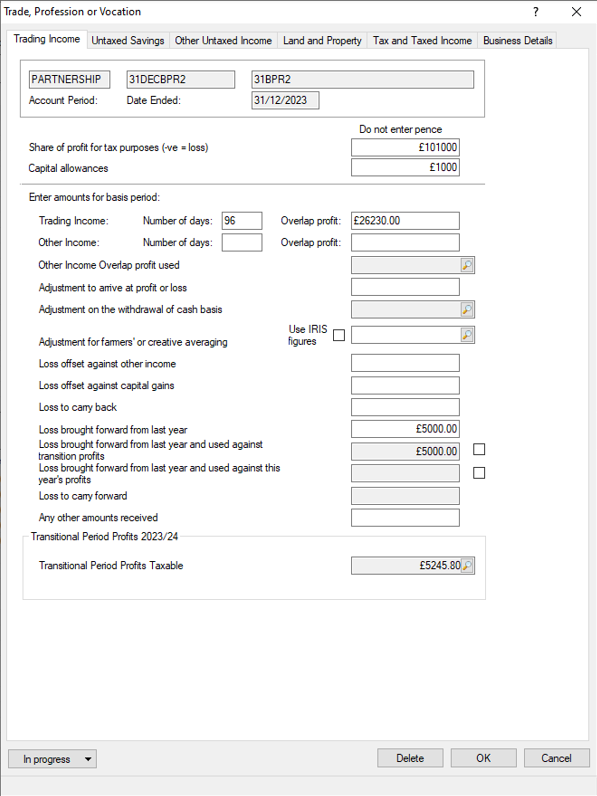

- Partnership - this is the

total Share of profit/loss for tax

purposes minus Capital Allowances for the standard accounting

period and maps to box 8 on

the Partnership pages.

Transition Part (To 5th April 2024)

Step 2: Apportioned profit/(loss) for tax purposes

- Sole trade - this is the

apportioned Net business profit/loss for tax purposes from the next/future

accounting period and maps to box 73.1 on the Self-employment pages.

- Partnership - this is the

apportioned ‘Share of profit/loss for tax purposes minus Capital Allowances’

from the next/future accounting period and maps to box 16.1

on the Partnership pages.

Overlap profit - this is all existing

Overlap Profit b/fwd or Arising in the period. If the checkbox is ticked,

then the value can be overridden.

- Sole trade - maps to box

73.2 on the Self-employment pages.

- Partnership - maps to box

16.2 on the Partnership pages.

Step 3: Apportioned profit/(loss) after

overlap - this field is the result of

Step 2 – Overlap Profit.

If the result is negative, then

all the remaining fields in this screen will be zero.

Transition Profit

Step 4: (Step 1 & Step 3 total) - this

field is the result of Step 1 + Step 3.

If Step 3 and/or step 4 is nil or a loss, then this is total

profit/loss for the basis period.

Treatment of a loss (or increased loss) arising from this step can be

found here BIM81300.

Total transition profit (lower of Step

3 & Step 4) - this is the lower of Step 3 and Step 4.

Taxable profit 2023/24

Step 5: Apportioned transition profit - this

field is 20% of the total transition profit (Spreading of transition profit

over 5 years).

If the checkbox is ticked, then the value can be overridden up to the

transition profit amount. A value less than the calculated 20% should

not be entered.

- Sole trade - maps to box

73.3 on the Self-employment pages.

- Partnership - maps to box

16.3 on the Partnership pages.

Transition profit carried forward

- this is the remaining transition profit not used in Step 5.

Transitional Period Profits 2023/24

Transitional period profits arising

- this field is the Total transition profit.

Transition period profits taxable

- this is Step 5: Apportioned transition profit.

Transition period profits carried forward

- this is Transition profit carried forward.

Opt out of the late accounting date

rules - if this box is ticked, then any end date from 31/3/2024

– 5/4/2024 will not be treated as 5/4/2024, and transition profits

will be calculated accordingly.

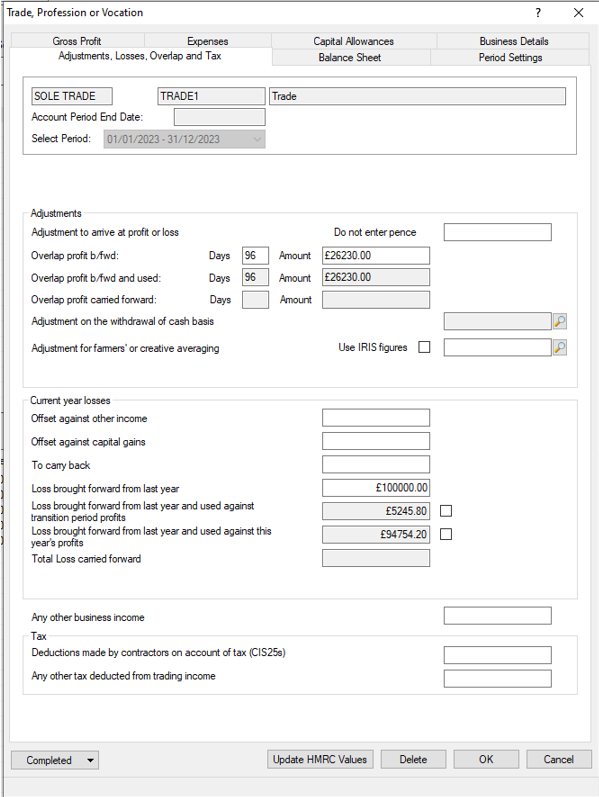

Overlap and Losses

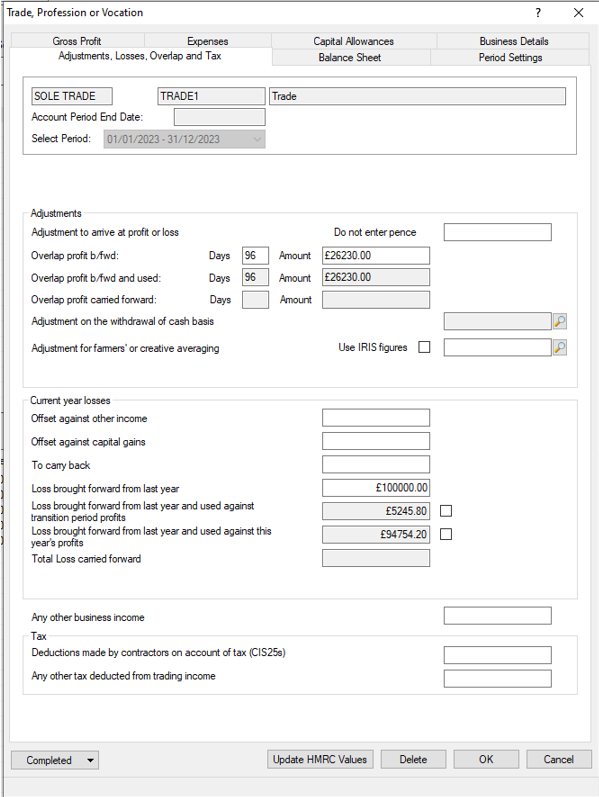

For Sole trades , select the Adjustments, Losses, Overlap and Tax

tab.

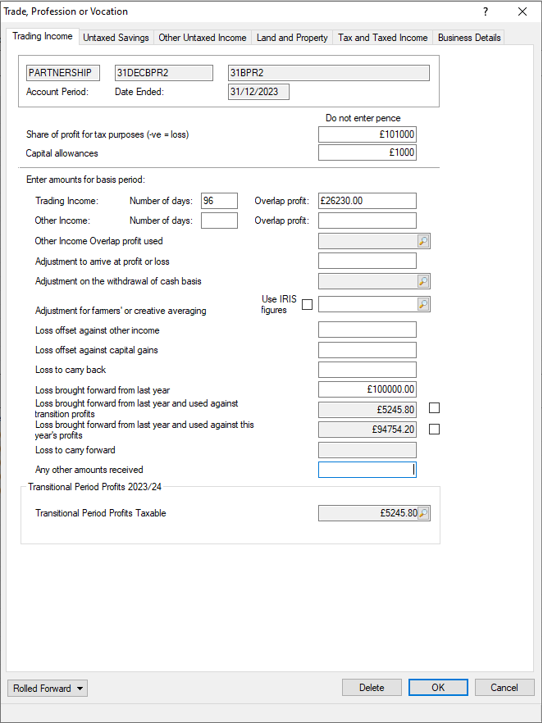

For Partnerships, the

Overlap and loss fields are on the Trading

Income screen.

- Overlap profit b/fwd and used

– all existing Overlap profit

will show in this field and if the business requires a transitional

profit calculation then the value will flow through to the Transitional

period profits screen

- Loss brought forward from last

year and used against transition period profits - this field

is auto populated.

When override is ticked:

- The value entered cannot exceed loss brought forward and transition

profit.

- Loss brought forward available for profit must be used

Maps to:

- Sole trade - box

73.4 on the Self-employment pages.

- Partnership - maps to box 16.4 on the Partnership pages.

Loss brought forward from last year

and used against this year’s profits - this field is auto populated.

When override is ticked:

- The value entered cannot exceed loss brought forward and this year’s

profit.

- Loss brought forward available for profit must be used.

Maps to:

Sole trade - box

74 on the Self-employment pages.

Partnership - maps to box 17 on the Partnership pages.

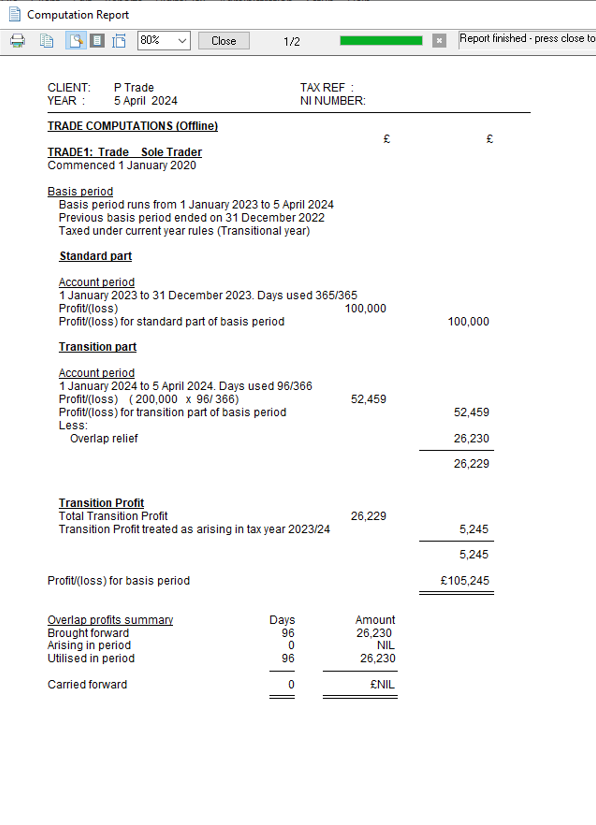

Trade computation

The trade computation shows a transitional year computation:

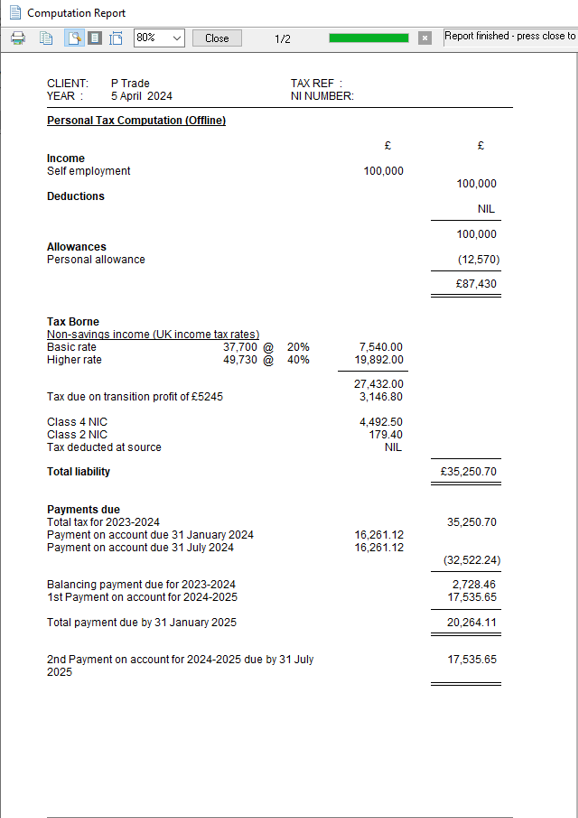

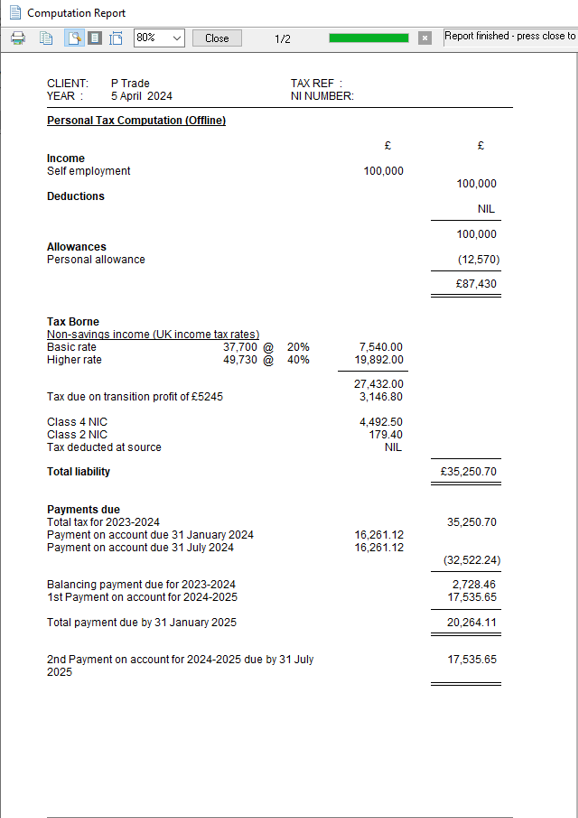

Tax Computation

The Tax Computation shows a line for Tax due on transition profit:

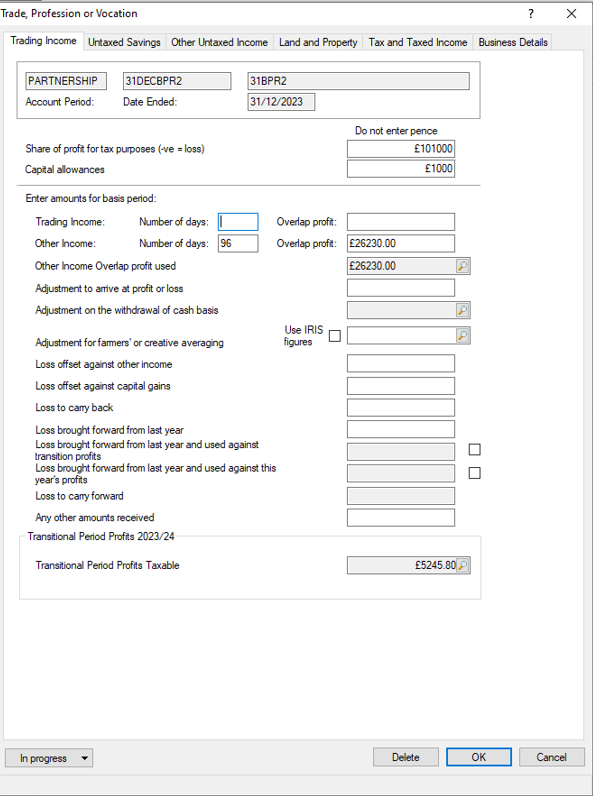

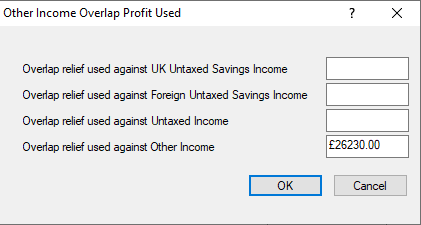

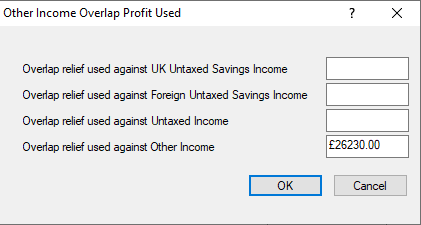

Other Income

All Other income Overlap Profit must be used.

Other Income: Overlap

Profit – All existing.

Other Income Overlap profit used

– all Overlap profit entered in the field ‘Other Income: Overlap Profit’

field will show as used.

Select the magnifying glass next to Other

Income Overlap profit used.

This will open the Other Income Overlap

profit used screen.

The Other Income overlap profit amount is automatically allocated to

‘Overlap relief used against Other Income’, however this amount can be

reassigned to the other fields.

Overlap relief used against UK Untaxed

Savings Income – this maps to box

34.1.

Overlap relief used against Foreign

Untaxed Savings Income – this maps to

box 34.1.

Overlap relief used against UK Untaxed

Savings Income – this maps to box

65.

Overlap relief used against UK Untaxed

Savings Income – this maps to

box 66.

Overlap relief must firstly be used against UK Untaxed savings Income

or Foreign Untaxed Savings Income and populated in

box 34.1.

Then the relief should be used

against Untaxed Income and populated in box

65 and the remaining overlap relief must be used against Other

Income and populated in box 66.