|

|

This guide is meant for use as a reference for those using the IRIS OpeniXBRL online service. IRIS OpeniXBRL enables accounts written in Microsoft Word® to be converted to an iXBRL document which can then be submitted to HMRC as part of a corporate tax filing.

The guide contains instructions on how to prepare an accounts document prior to uploading to IRIS OpeniXBRL. It gives detailed instructions for applying the tags required to meet the Joint Filing Common Validation Checks required for submission to HMRC. Finally, it gives an explanation of common errors and how to resolve them.

This guide is for reference only, please see the online help for detailed information on how to use IRIS OpeniXBRL.

This chapter covers how to verify that the source accounts are prepared correctly for use with IRIS OpeniXBRL. The following guidelines for preparing your Word accounts document will enable you to make the most of IRIS OpeniXBRL's auto tagging capabilities.

File format. The accounts must be in Word 2007 (".docx") format for the document to be recognised by IRIS OpeniXBRL. Any accounts in other formats should be converted to Word 2007 before uploading.

Table format. For the best auto tagging performance, financial tables should be in Word table format rather than tab-aligned or white space tables. Word has built-in tools to convert text to table format. In addition, to make the best use of auto tagging, table columns should represent the context of the facts (e.g. dates) and row headings should represent report line items (e.g. turnover).

Embedded objects. The source accounts should not contain information to be tagged in embedded objects as these will not be included in the final iXBRL file. Information held in embedded Excel, Word, PDF or other formats should be moved into the main document as text or tables before uploading.

Special text types. Special text types such as headers or hyperlinks will not be included in the converted iXBRL document and so any information that needs to be tagged should be moved to the main text.

Rich content. The final iXBRL document will be text-based and so rich media content such as charts or pictures will not be included. Any information that is held in rich content and needs to be tagged, should be moved to tables or the main text.

File size. The file size of the source document should not be more than 15MB. Usually very large file sizes are the result of embedded content. Removing any embedded content will make the file size smaller.

Required information. HMRC require that certain pieces of information are always included in iXBRL accounts submitted through the Government Gateway. Prior to uploading you should ensure that the information outlined in, Passing the Joint Filing Common Validation Checks (JFCVC), is included in the text of your accounts.

The first step in passing the JFCVC is to ensure that the following required information is present in your accounts. If these are not included and tagged, you will not be able to successfully submit the resultant iXBRL to HMRC.

Company name

Company Registration Number

Period start date for the accounts

Period end date for the accounts

Balance sheet date

Date of approval of the balance sheet

Name of the director approving the balance sheet

If the accounts include a profit and loss account, the final profit or loss over the period

Date of signing for the directors' report

Name of the director approving the directors' report

The following table lists the JFCVC and gives the steps required to tag each item. Version 1.0 of the JFCVC document can be found here: joint_filing_validation_checks.pdf.

For items marked as "Manually tag", you should select the relevant text before choosing the appropriate concept and reviewing the tag details. To go straight to the correct concept, you can search for the text given as the concept label in brackets below.

Table 3.1. Joint filing common validation checks

| Validation | Steps in IRIS OpeniXBRL | |

| HMRC Ref | Rule

(Label of Concept Affected) |

|

| 1 | Company name is MANDATORY

(Entity current legal or registered name) |

Manually tag. |

| 2 | Period Start Date is MANDATORY

(Start date for period covered by report) |

Manually tag, leaving the Date field as the value that is automatically filled in (the end of period date). |

| 3 | Period End Date is MANDATORY

(End date for period covered by report) |

Manually tag, leaving the Date field as the value that is automatically filled in (the end of period date). |

| 4 | Period Start Date MUST be 6 April 2008 or later

(Start date for period covered by report) |

Always true for new filings. |

| 6 | Balance Sheet Date is MANDATORY

(Balance sheet date) |

Manually tag, leaving the Date field as the value that is automatically filled in (the end of period date). |

| 7 | Balance Sheet Date of Approval is MANDATORY

(UK-GAAP: Date of approval of accounts UK-IFRS: Date of authorisation of financial statements for issue) |

Manually tag, leaving the Date field as the value that is automatically filled in (the end of period date). |

| 8

GAAP |

Name of Director Approving Balance

Sheet is MANDATORY

(UK-GAAP: This is a hidden tag) |

|

| 8 IFRS | Name of Director Approving Balance Sheet is MANDATORY

(UK-IFRS: Explanation of body of authorisation /Description of body authorising financial statements) |

Manually tag. |

| 9 | Dormant/non-dormant indicator is MANDATORY (Entity is dormant) | Add "true" or "false" as a hidden tag.

|

| 10 | Trading/non-trading indicator is MANDATORY (Entity is trading) | Add "true" or "false" as a hidden tag. |

| 11 | Profit or Loss for the period is MANDATORY if the Accounts contain a P&L account (UK-GAAP: Profit (loss) for the period UK-IFRS: Profit (loss)) |

Review the auto tag suggestions of the P&L account table.

|

| 12 | Date of signing Directors' Report is MANDATORY (Date of signing of Directors' Report) | Manually tag, leaving the Date field as the value that is automatically filled in (the end of period date). |

| 13 | Name of Director signing Directors' Report is MANDATORY (This is a hidden tag) |

|

| 14 | Reject inconsistent duplicate fact values, taking into account declared precisions for numeric facts (Any primary items) |

It is acceptable to tag the same fact in multiple places in the doc- ument, but care should be taken that they have the same value. |

| 15 | A Name or Description item MUST exist for each generic dimension member used (Name* or Description* items) |

Every time a generic dimension member is used, e.g. Director 1, the member should be manually tagged in the document. Examples of this are given in items 8 and 13. |

| 16.1 | For IRIS OpeniXBRL, the Company Reference Num is MANDATORY (UK Companies House registered number) |

Manually tag.

|

| 16.2 | For IRIS OpeniXBRL, the filer must be created with the correct Company Registration Number | The Company Registration Number is requested when each filer is created. If this was not filled in correctly, it can be changed after creating the filer by clicking Edit from the Manage Filers screen. |

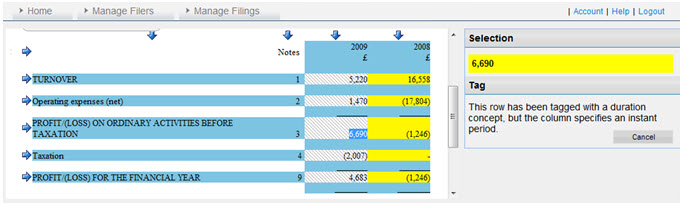

During the auto tagging process it is possible to attempt to tag in a way that would lead to invalid iXBRL. IRIS OpeniXBRL shows that this is the case by marking facts with diagonal stripes.

Figure 4.1. Striped tagging errors

If you click on the striped-highlighted tag, then a message will be displayed explaining what the error is. The table below gives advice on how to resolve common auto tagging errors. All the errors listed in the table are as a result of the line item concept not being compatible with the selected column context. In general, you will need to select a column context that matches the largest number of line items possible and then manually tag line items that are not compatible with this context.

Table 4.1. How to resolve common tagging errors

| Reported error | How to resolve |

| This row has been tagged with a duration concept, but the column specifies an instant period. |

|

| This cell has not been tagged because its grouping information was missing or not valid. |

|

| This cell has not been tagged because the specified combination of units and concept type is invalid. |

|

| This cell has not been tagged because its column context is missing dimensional information required by its row line item. |

|

| (No error message) Where there is a yellow-highlighted confirmed value and diagonal highlighting surrounding it. |

|