|

|

IAS 19R is applicable to periods starting on or after 1 January 2013.

IAS 19R will only apply to Companies using International Financial Reporting Standards (IFRS).

This is only available for Limited Companies and International Groups.

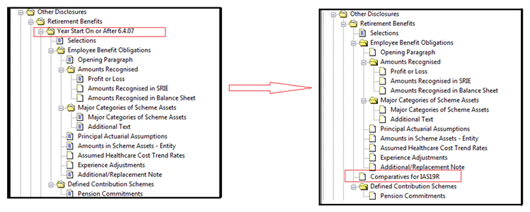

IAS 19R Employees Benefits Obligations introduces

recognition of changes in the Net Defined Benefit Liability including

immediate recognition of Defined Benefit Cost, Disaggregation of Defined

Benefit Costs into components, Recognition of Re-measurements in Other

Comprehensive Income and lastly Plan Amendments.

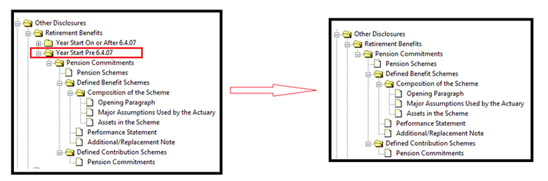

Changes have been made to the following Data Screen, Edit

| Data screen | International

| Notes to Financial Statements

| Other Disclosures | Retirement

benefits

Reference to Year Start Pre 6.4.07

and Year Start On or After 6.4.07

has been removed.

The Data screen will now show the appropriate folder based on the accounting period:

Select the following Data Screen, Edit | Data screen | International | Notes to Financial Statements |Other Disclosures | Retirement Benefits | Comparatives for IAS 19R to allow comparatives to be entered on screens for IAS19R disclosure for an accounting period starting before 1 January 2013.

If you amend the entry in the above box, you should save the screen, exit and re-load the data screens. Relevant screens will then become available Account Codes.

The ELTD Chart of Accounts has been updated to include the following Account Codes, which are now available for Employee Benefit Obligations:

957/16-18 (Obligation actuarial gain/loss)

957/36- 37 (Assets)

960/16-18 (Obligation actuarial gain/loss)

960/36- 37 (Assets)